Tax on Savings

Deposit Interest Retention Tax (DIRT)

If you’re saving money in an Irish or foreign bank account then you must understand how deposit interest is taxed and how to correctly declare it on your tax return.

Reading time: 15 min

Last updated: January 15, 2026

Table of Contents:

Written by:

Dan Malone

How DIRT Affects Your Interest

When you earn interest on your savings, it’s added to your balance and treated as income. You must pay Deposit Interest Retention Tax (DIRT) on that income. Remember that when you’re looking at the best high-yield savings accounts. When you save with an Irish bank, this tax is paid automatically before you get your interest. Pretty convenient!

Foreign banks on the other hand don’t deduct this tax automatically. It’s your responsibility to declare the interest on your tax return and pay DIRT on it. There is a hidden benefit to this. You get to receive all your interest up front and can delay paying your tax until the deadline. That means more money for you to play with.

How Much is DIRT Tax on Savings in Ireland?

The current rate of Deposit Interest Retention Tax (DIRT) in Ireland is 33%.

- If you earned €100 interest with an Irish bank, you’d get €67 after the bank deducted the tax.

- If it was a foreign bank, you’d get €100 up front and pay tax later on.

If you’re saving with a foreign bank, DIRT might exceed 33%. This will depend on what country that bank has its license in:

For EU and EEA banks, 33% DIRT will apply to the interest. This only happens if you include it in your tax return and file on time. If it’s not filed on time, a higher tax rate of 40% will apply.

For UK, US and other non-EU/EEA banks, DIRT at 33% will apply, but if you’re a higher rate taxpayer, you’ll pay 40%. You’re a higher rate taxpayer in Ireland if you earn more than €44,000 in 2026. If your tax return isn’t filed on time, you’ll always pay 40%.

DIRT is considered a final tax liability. This means you won’t have to pay Income Tax or Universal Social Charge (USC) on your interest. The only extra tax that could come up is Pay-Related Social Insurance (PRSI). If your income from deposit interest, rent and investments exceeds €5,000, then you need to pay 4.2% PRSI on your interest. This doesn’t give you any extra social insurance benefits.

Requirements for Deducting DIRT

DIRT will be paid on your behalf if two factors are met, both must be satisfied for automatic deduction to apply:

Revenue must classify the financial institution as a ‘Relevant Deposit Taker’. A Relevant Deposit Taker includes:

- A licensed bank of any EU member state, including Ireland.

- A building society of any EU member state, including Ireland.

- A trustee savings bank.

- The Post Office Savings Bank.

- A credit union.

The financial institution must operate in Ireland. This can be through direct establishment, like AIB, Bank of Ireland or PTSB. Alternatively, it can be an Irish branch of a foreign bank, like Revolut or MoCo.

Non-Irish banks such as Trade Republic, Bunq, N26 and the European banks on Raisin don’t meet this requirement. You’re earning interest from a non-Irish bank. This is why they don’t deduct DIRT from your interest. They may deduct foreign withholding tax depending on the tax law of the country where their banking license is.

As these banks are ‘passporting’ their banking services from their home country to Ireland, they are under the Central Bank of Ireland’s supervision for conduct of business rules. It’s possible Revenue might see them as operating in Ireland in the future and require DIRT to be deducted. But that doesn’t concern you for now.

Your main priority is establishing:

- Whether Irish DIRT has been deducted and, if not;

- The location of the banking license to determine the correct rate of tax to be paid.

DIRT Tax Exemptions on Savings

You could be exempt from paying Deposit Interest Retention Tax (DIRT) if you meet one of the following criteria:

If you’re over 65 years of age and your total income is less than €18,000 then you’ll be exempt from DIRT. For married couples and civil partners, only one person needs to be over 65 for the exemption to apply. The combined income of the couple must be less than €36,000.

Your limits can be increased if you have dependent children who are under the age of 18 or became incapacitated before they turned 21. You limit will be increased by:

- €575 per child for your first two children

- €830 per child for each extra child

If you’re not tax resident in Ireland, you’ll be exempt from DIRT if:

- You’ve completed a non-resident declaration; and

- You don’t pay tax in Ireland; and

- You don’t have a joint bank account with an Irish tax resident person

- Permanently incapacitated because of a physical or mental disability.

- Receiving payments from the Mother and Baby Institutions Payment Scheme (MBIPS).

- Receiving a relevant payment under the CervicalCheck measure introduced by the Minister for Finance in Budget 2025. This relates to women impacted by failures in the national screening programme.

Non-Natural Individuals

The following entities are exempt from paying DIRT:

- Companies that pay corporation tax.

- Revenue-approved pension schemes.

- Pan-European personal pension product providers.

- Charities.

How to Apply for DIRT Tax Exemptions

How you apply for a DIRT exemption will depend on the exemption that you’re claiming:

- Over 65 Exemption: Complete a Form DE1 and submit to your financial institution.

- Permanently Incapacitated Exemption: Complete a Form DE2 and submit to your local Revenue Office.

- MBIPS Exemption: Complete a Form DE3 and submit to your local Revenue Office.

- CervicalCheck Exemption: Complete a Form DE4 and submit to the Sensitive Cases Unit of Revenue.

The conditions for each DIRT exemption must continue to be met in order for the exemption to remain valid, a change in your circumstances may affect your qualification for a given exemption.

Who Can Claim DIRT Back

You can claim a refund of Deposit Interest Retention Tax (DIRT) in these situations:

- You’ve turned 65 years of age; or

- You’re already 65 and your income exceeded the limits for a short period; or

- You’ve become incapacitated; or

- You’ve applied for an exemption, but DIRT was already deducted.

If you’re not an Irish tax resident and qualify for an exemption, but have already paid DIRT, you can claim a refund if your home country has a Double Taxation Agreement (DTA) with Ireland. You’ll need to complete a Form IC5 to claim the refund.

First-time buyers can apply for a refund of DIRT under the Help to Buy scheme.

Tax on Foreign Saving Accounts

Some foreign banks will take their own tax from your interest. They call this foreign withholding tax. Foreign withholding tax and DIRT are not the same thing. If a foreign bank takes foreign tax from your interest, you’ll still have to pay Irish tax to Revenue.

Whether a foreign bank charges tax will depend on the tax rules of the country where the bank is based. For example, if you have a savings account with a bank in France, Germany, Italy, Luxembourg, Malta, Norway or Sweden, the bank won’t charge foreign tax.

But if you have a savings account with a bank in the Czech Republic, Latvia, Lithuania, Portugal, Spain or Slovakia, then the bank will deduct foreign tax from the interest.

Fortunately, Ireland has tax agreements with these countries, and many more. These agreements help to lower the foreign tax you’ll pay. These agreements are called Double Taxation Agreements (DTAs). They’re needed because when you earn foreign interest, both Ireland and the other country might claim the right to tax it. Without an agreement, Irish savers could end up paying tax twice.

Here’s how they work. Each agreement will set the rules for how interest is taxed in Ireland and the other country, including the foreign tax rate. For example, in Ireland’s agreement with Portugal, the rate can be no more than 15%.

Key Insight:

If you’re saving with a bank that charges foreign withholding tax, make sure to provide them with proof of your Irish tax residence. This will lower the foreign tax on interest to the rate that’s stated in Ireland’s agreement with that country, possibly to 0%. If you don't, the foreign tax could be higher.

If you earned €100 interest in a Portuguese bank account here’s how your tax would be calculated:

| Gross Interest | €100 |

| Irish DIRT at 33% | €33 |

| Minus Portuguese Withholding Tax (15%) | (€15) |

| Irish Tax Due | €18 |

If the Portuguese bank took more than 15%, which could happen if you didn’t provide proof of your Irish tax residence, the calculation would still be the same. Revenue will only give you a credit for foreign tax up to the maximum rate noted in Ireland’s DTA with that country. It’s important to provide proof of your Irish tax residency to the bank, to avoid paying tax on the same income twice.

If you’ve paid foreign tax that’s higher than the rate in Ireland’s DTA, you can ask the foreign tax authorities for a refund. But let’s be real, nobody wants to have to do that. The solution? Before making a deposit with a foreign bank, make sure the rate of foreign tax, if any, is not higher than the allowed rate under Ireland’s DTA with the country where the foreign bank has its license. If it is higher, you may be able to reduce it by providing proof of your Irish tax residence.

All of Ireland’s DTAs with countries around the world are publicly available online. Found the relevant DTA? Check the ‘Interest’ section in the agreement for the maximum foreign withholding tax rate.

To avoid the hassle of foreign withholding tax, just use banks who don’t charge it. Marketplace platforms, like Raisin, conveniently mark the savings accounts which don’t have withholding tax so you know which ones they are. With these accounts, the interest you receive is the interest you pay tax on, making life easy for you.

How To File a DIRT Return

How you file your Deposit Interest Retention Tax (DIRT) return depends on:

- Whether you’re using MyAccount or ROS; and

- What country the deposit interest is coming from

You’ll be a MyAccount user if you’re:

- Not self-employed; and

- Have non-PAYE income (rent, dividends, deposit interest) less than €5,000 (net) or €30,000 (gross)

Self-employed people need to register for income tax self-assessment and file a Form 11 tax return using Revenue Online Services (ROS). MyAccount users will file the much simpler Form 12.

Key Insight:

MyAccount users must register for income tax self-assessment and file a Form 11 if their non-PAYE income exceeds €5,000 (net) or €30,000 (gross). This applies even if your only source of non-PAYE income is Irish deposit interest, which has already been subject to automatic DIRT!

In that case, you’d have to declare the gross Irish interest on your return, but no DIRT would be owed as it was already paid. But you’d have to pay 4.2% Class K PRSI on the interest because your unearned income exceeds the threshold.

Deposit interest of €7,462.69 or more, whether Irish or foreign, exceeds the threshold (i.e. more than €5,000, net of 33% DIRT). This figure will be lower if you have other sources of non-PAYE income.

To declare foreign interest from a bank that has its banking license in an EU/EEA country you need to:

- 1Sign into MyAccount

- 2Under ‘PAYE services’ click “Review Your Tax”

- 3Select the tax year that the interest was received

- 4Under ‘Statement of Liability’ click “Request”

- 5Select “Complete Your Income Tax Return” (this is the Form 12)

- 6Go to ‘Foreign Income’ and click “EU Deposit Interest (excluding UK interest)”

- 7Enter the gross interest earned from EU/EEA bank accounts under “Amount of EU Deposit Interest”

- 8If any foreign withholding tax was paid, enter this under “Other Foreign Tax Deducted”

- 9Finish the Form 12

Key Insight:

For Step 7, the gross interest earned isn’t always what you actually received. If foreign withholding tax was deducted, you’ll have received less. But you must enter the interest before foreign withholding tax in this box. Revenue calculates DIRT using gross interest first. Then, it applies a tax credit for any foreign withholding tax that you declared in Step 8.

To declare foreign interest from a bank that has its banking license in an EU/EEA country you need to:

- 1Go to Section F ‘Foreign Income’ on your Form 11

- 2Under ‘EU Deposit Interest’, enter the gross interest earned from EU/EEA bank accounts under “Amount of EU Deposit Interest”

- 3If any foreign withholding tax was paid, enter this under “Foreign Tax”

- 4Finish the Form 11

To declare foreign interest from a bank that has its banking license in a non-EU/EEA country you need to:

- 1Sign into MyAccount

- 2Under ‘PAYE services’ click “Review Your Tax”

- 3Select the tax year that the interest was received

- 4Under ‘Statement of Liability’ click “Request”

- 5Select “Complete Your Income Tax Return” (this is the Form 12)

- 6Go to ‘Foreign Income’ and click “Non-EU Deposit Interest (including UK Deposit Interest)”

- 7Enter the gross interest earned from non-EU/EEA bank accounts under “Gross Amount of Non-EU Deposit Interest (including UK Deposit Interest)”

- 8If any foreign withholding tax was paid on this income, you should declare it in the ‘Tax Credits & Reliefs’ section under “Foreign Tax Amounts”. You’ll need to specify the country, the type of income (deposit interest) and the amount of foreign tax deducted

- 9Finish the Form 12

To declare foreign interest from a bank that has its banking license in a non-EU/EEA country you need to:

- 1Go to Section F ‘Foreign Income’ on your Form 11

- 2Under ‘Non-EU Deposit Interest (includes UK Deposit Interest)’, enter the gross interest earned from non-EU/EEA bank accounts under “Amount of Non-EU deposit interest”

- 3If any foreign withholding tax was paid, enter this under “Amount of foreign tax deducted”

- 4Finish the Form 11

When completing your income tax return through MyAccount (Form 12), you need to declare Irish deposit interest that has already been subject to DIRT. No additional tax will be due:

- 1Sign into MyAccount

- 2Under ‘PAYE services’ click “Review Your Tax”

- 3Select the tax year that the interest was received

- 4Under ‘Statement of Liability’ click “Request”

- 5Select “Complete Your Income Tax Return” (this is the Form 12)

- 6Go to ‘Other Income’ and click “Deposit Interest Received”

- 7Under “Number of ordinary deposit accounts” include the total number of accounts you hold with Irish banks, building societies, trustee savings banks, Post Office Savings Bank and credit unions

- 8Under “Gross interest received on which DIRT was deducted at 33%” include the gross deposit interest (before DIRT) received from all of the accounts referenced in Step 7

- 9The field “Gross interest received on which DIRT was not deducted” should not be used for declaring foreign deposit interest (see previous sections 1 & 3) but instead for declaring Irish deposit interest where DIRT wasn’t deducted because of an active exemption

- 10The field “Gross interest received from Special Savings Account(s)” can be ignored unless you still have one of these legacy accounts from the early 2000s

- 11Finish the Form 12

- 1Go to Section G ‘Irish Other Income’ on your Form 11

- 2Under ‘Irish Deposit Interest / Credit Union Dividends’, enter the gross interest earned from Irish banks, building societies, trustee savings banks, Post Office Savings Bank and credit unions under “Gross Deposit Interest / Credit Union Dividends received on which DIRT was deducted”

- 3The field “Gross interest received from Special Savings Account(s) on which DIRT was deducted” can be ignored unless you still have one of these legacy accounts from the early 2000s

- 4If you received any Irish deposit interest that wasn’t subject to DIRT because of an exemption enter it under “Gross interest received where DIRT was not deducted by virtue of S. 256(1A) or S. 256(1B)”

- 5Finish the Form 11

Deadline to File and pay DIRT on Interest

You need to declare your interest on your tax return and pay the tax owed by the 31st October of the year following the year in which the interest was received. For example, for deposit interest received in 2026, the tax filing and payment deadline is October 31st 2027.

Key Insight:

To avoid paying a higher DIRT rate of 40%, as well as extra Revenue charges and interest, make sure to file your tax return and pay the tax owed before the deadline.

DIRT Frequently Asked Questions

No, having an Irish IBAN or saving with an Irish branch of a foreign bank does not mean DIRT will always be paid automatically. Where DIRT hasn’t been deducted, you’ll need to check where the bank has its banking license to confirm what tax rate applies.

Ireland has Automatic Exchange of Information agreements with countries around the world. This means that Revenue receives information about account balances and interest payments that Irish tax residents have in foreign savings accounts.

Yes, interest earned through children’s savings accounts are subject to DIRT in the same way as adult accounts. If the child is eligible for a DIRT exemption, then it should be applied for to avoid the tax.

No, there are no current plans to increase the rate of DIRT. The last time DIRT changed was in 2020 when it decreased from 35% to the current rate of 33%. Since 2002, DIRT has been as low as 20% and as high as 41%.

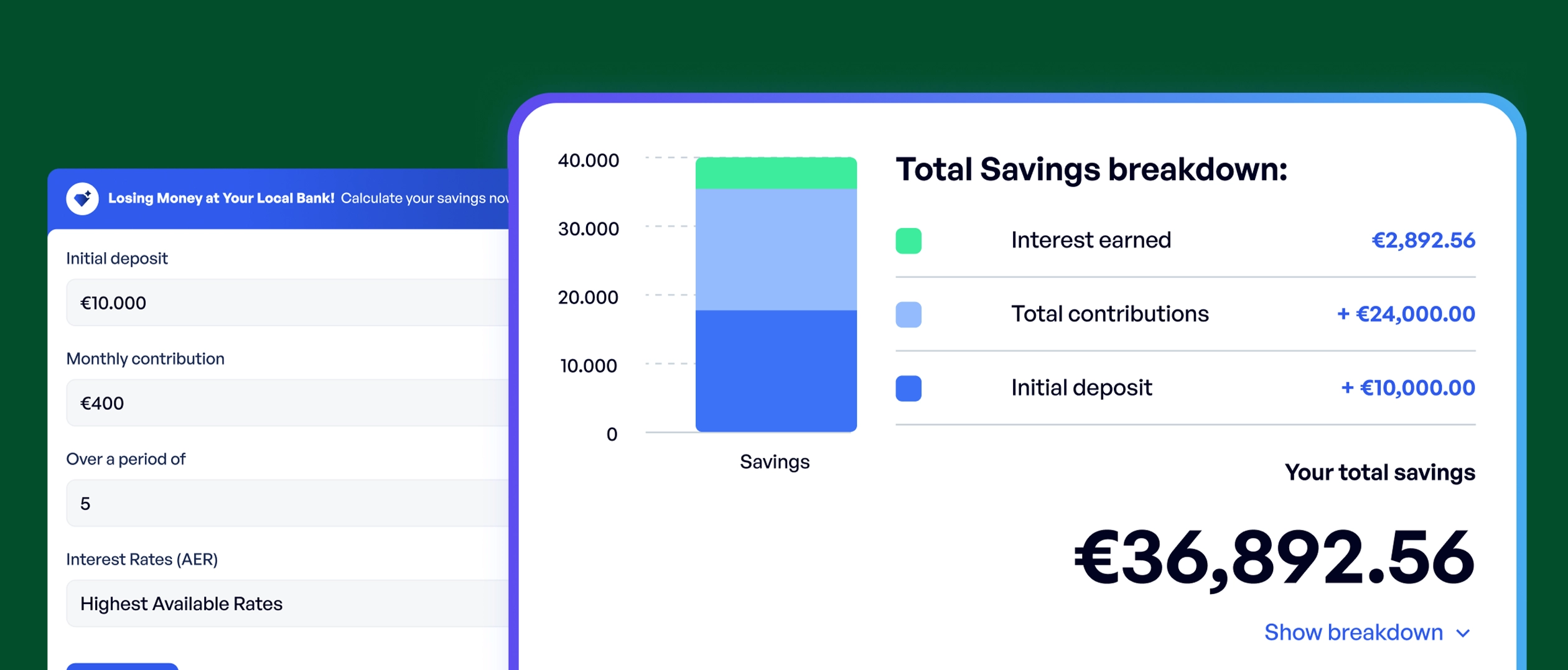

Savings Calculator

Calculate how much you can save over time, and get matched with the best accounts.

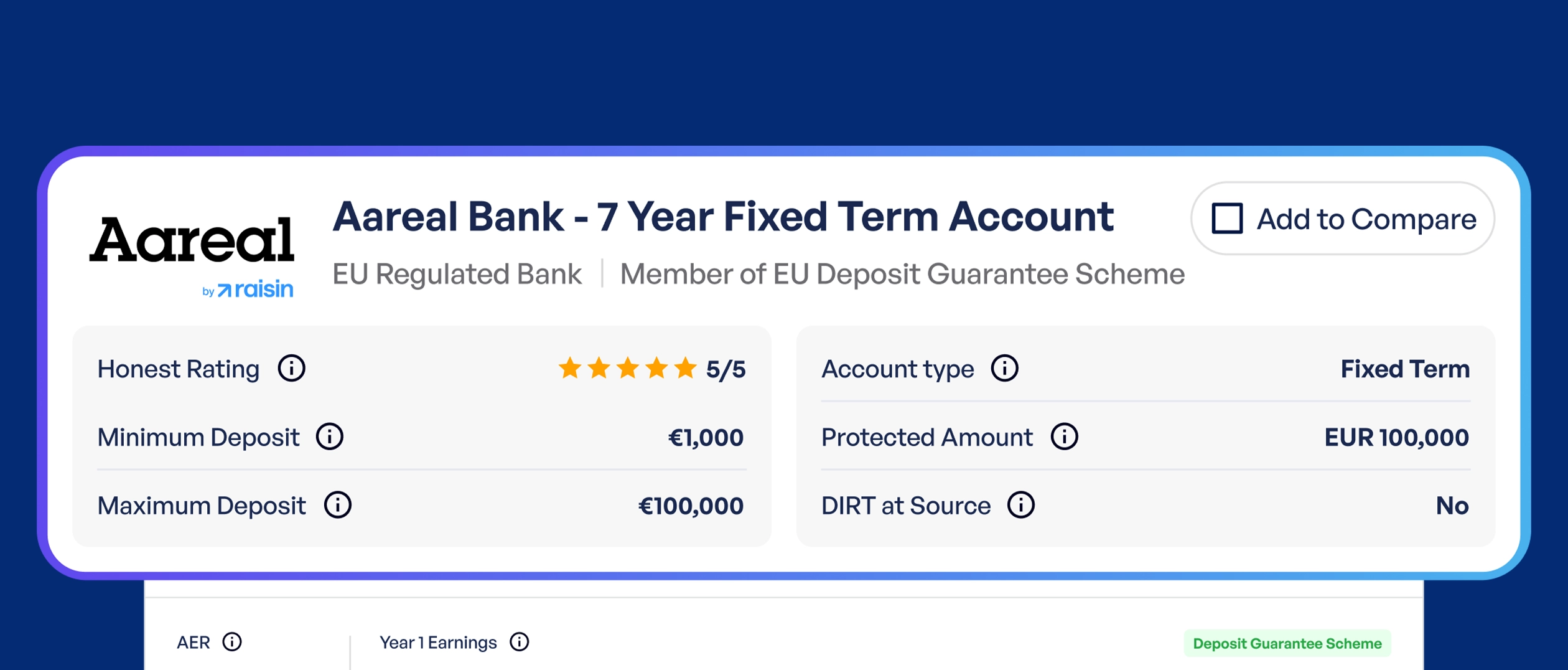

Savings Comparison Tool

Compare over 200 savings accounts side-by-side for detailed analysis.