Best High-Yield Savings Accounts in Ireland 2026

A high interest savings account can be a great way to earn interst on money that you don’t plan on spending right away. Today’s highest interest savings account is 3.05% offered by Aareal Bank AG. That’s 24 times higher than the national average of 0.13%. The best savings accounts in Ireland have high annual equivalent rates (AERs), no fees, low minimum deposits and high maximum deposits.

Reading time: 23 min

Last updated: February 4, 2026

Table of Contents:

Written by:

Dan Malone

This table shows the highest AER accounts with a 5-star Honest transparency score. We do this to improve comparisons. To see all accounts and learn more about Honest Ratings, please see the dedicated comparison tool.

How do Irish Savings Accounts Work?

Irish savings accounts work by paying you a regular sum of money, known as ‘interest’, on the cash that you keep in the account. Here’s how a savings account in Ireland works, step by step:

Step 1: You Lend Money to the Bank

When you open a savings account with a bank and put money into it, you’re said to be ‘making a deposit’ with the bank. Think of your deposit as a loan from you to the bank.

Step 2: The Bank Pays You Interest

When you lend money to the bank, they pay you interest in return. This makes sense. If you have to pay the bank interest on your mortgage, why shouldn’t they have to pay interest on their deposits?

How much interest the bank pays you depends on two key factors: the size of your deposit and the annual equivalent rate (AER) attached to the savings account.

Depositing larger sums and choosing a savings account with a high AER will help your money grow faster, providing you with better returns over time.

Step 3: The Bank Lends Out Your Money

The bank will take your deposit and lend it out to its customers who are looking for a mortgage or personal loan. These are known as ‘borrowers’. Don’t worry, this is perfectly safe and a common feature of modern banking.

Key Insight:

The difference between the interest rate that the bank pays to its depositors and the interest rate that it charges to its borrowers is the bank’s profit. This is known as the ‘net interest margin (NIM)’ of the bank. The higher the bank’s NIM, the more profitable it will be.

Step 4: Your Money Grows

The interest that you earn will continue to be added to your total balance, even if you don’t make any further deposits. Your interest will start to earn interest of its own. This is known as ‘compound interest’ and it’s the secret ingredient to growing your money over time.

Certain savings accounts won’t allow your deposit to benefit from compound interest but this will be reflected in the advertised AER, which will be lower as a result.

What is the Deposit Guarantee Scheme?

The Deposit Guarantee Scheme (DGS) is an EU law that protects deposits held with banks up to the value of €100,000. That’s €100,000 per depositor, per bank. This applies to savings accounts both in Ireland and throughout the EU, making them perfectly safe for use.

For more information, please see our Deposit Guarantee Scheme page.

Choosing the Right Savings Account - Accessibility vs. Interest Rate

There are 3 core types of savings accounts in Ireland: instant access accounts, fixed term accounts and notice accounts. The two main factors that set these accounts apart are:

- 1

Accessibility - whether or not withdrawals can be made on demand.

- 2

Interest Rate - how high the annual equivalent rate (AER) is and whether it’s ‘variable’ or ‘fixed’.

There is a basic tradeoff between these two factors:

| Accessibility | Interest Rate (AER) |

|---|---|

| High | Low and variable |

| Low | High and fixed |

If you need to be able to withdraw your money on demand, then you can expect to earn less interest through a lower, variable AER. If accessibility isn’t an immediate concern for you, then you can expect to earn more interest through a higher, fixed AER.

Instant access savings accounts, also known as demand deposit accounts, are the most flexible type of savings account. These accounts allow you to withdraw your money whenever you need it, making them a perfect home for an emergency fund.

Because of this flexibility, instant access accounts usually offer the lowest AER, meaning you’ll earn less interest on your deposits.

The AERs offered on these accounts are ‘variable’, which means the bank can decrease (or increase) the rate of interest that you earn at any time.

Fixed term savings accounts, also known as term deposit accounts, store your deposit for a set period of time, known as the ‘fixed term’. You can’t withdraw your money until the fixed term ends, so you must be certain that you won’t need it before depositing.

Because of this commitment, fixed term accounts usually offer the highest AER which is ‘fixed’, meaning the bank can’t change it until the end of the term. This is very valuable and a great way to lock-in a guaranteed interest rate for years.

Notice savings accounts are a blend between instant access and fixed term accounts. Think of notice accounts as the middle ground between being able to withdraw your money immediately and not being able to withdraw it at all. You can access your savings, so long as you give the bank advance notice.

This is called the ‘notice period’, which is commonly 7, 21, 31 or 40 days in Ireland, depending on the account.

Notice accounts usually offer variable AERs rates that are higher than instant access accounts but lower than fixed term accounts.

Key Insight:

The rule of thumb that AERs will be lower on instant access accounts than on fixed term accounts is often true when comparing accounts offered by the same provider.

However, this isn’t always the case when comparing accounts offered by different providers.

For example, an instant access account with one bank may offer an AER of 2.00% whereas a fixed term account with another bank may offer an AER of 1.50%.

Just because an account is instant access doesn’t mean it will offer a lower AER than every fixed term account on the market.

Beyond the Basics: Specialised Savings Products

Instant access, fixed term and notice accounts are the three core types of savings accounts in Ireland, but there are other subtypes of accounts and specialised savings products to be aware of:

For a full comparative guide on all seven types of savings products in Ireland, see our Types of Savings Accounts page.

How to Compare Savings Accounts

Regularly comparing savings accounts is very important. If your money is sitting idle in a low-interest savings account, or worse, your standard current account, you could be missing out on hundreds of euros worth of free interest. The best savings accounts in Ireland change all of the time because of shifting interest rates, new savings account providers and new savings products. As a result, you need to be comparing accounts at least once every six months.

By comparing savings accounts with Honest you’ll:

Get more free money

All banks don’t pay the same amount of interest, comparing accounts allows you to find the most competitive rates.

Grow your savings

The earlier you find the best deposit rates, the faster your savings will grow.

Find the best fit

Different accounts have different rules, you should have the account that best suits your needs.

Find the best savings account for you.

Why the Annual Equivalent Rate (AER) is so important

The annual equivalent rate (AER) is the main deposit interest rate that you should be looking at when comparing savings accounts in Ireland.

The AER is your clearest indicator of return, showing you exactly how much interest you will earn on your savings over a full year. Simply put, the higher the AER, the greater the growth potential for your money.

Why is the AER the Gold Standard for Comparison?

AER is important because not all banks calculate your interest in the same way. Without AER, it would be difficult to compare savings accounts as there wouldn’t be an apples-to-apples comparison.

AER does not show your net return after Deposit Interest Retention Tax (DIRT), which is automatically deducted by Irish banks, inflation or withholding taxes.

What is the difference between a Variable AER and a Fixed AER?

A variable AER can be increased or decreased at the bank’s discretion whereas a fixed AER cannot be changed by the bank until the end of the fixed term.

There are pros and cons to both:

Variable AER

Pros

Your interest rate can go up.

A feature of flexible savings accounts.

Your money isn’t locked in, allowing for easy switching.

Cons

Your interest rate can go down.

Unpredictable interest makes financial planning more difficult.

Banks can be quick to decrease rates, but slow to increase them.

Fixed AER

Pros

Your interest rate can’t go down during the fixed term.

Predictable interest makes financial planning easier.

Ability to lock-in a high rate for years before anticipated rate cuts.

Cons

Your interest rate can’t go up during the fixed term.

Your money is locked-in, meaning you can’t move it to a higher AER account.

A feature of inflexible savings accounts.

Access to Your Funds

Not all savings accounts allow you to withdraw money whenever you want. When comparing savings accounts, you need to understand how easy it will be to access your deposit, especially in an emergency.

Savings accounts in Ireland fit into one of three main categories based on how fast you can access your money: instant access, notice access and no access.

- 1

Instant Access (Demand Deposit): The most flexible type of savings account. You can withdraw your money immediately.

- 2

Notice Access (Notice Accounts): The middle option. You can withdraw your money, but only after you give the bank the agreed notice (can be between 7-40 days).

- 3

No Access (Fixed Term): Your money is fully locked away for an agreed term. Withdrawals cannot be made until the term ends. This is a feature of fixed term savings accounts.

What savings account you choose depends on your financial goal (i.e. building an emergency fund versus saving for a house deposit):

| Savings Goal | When It’s Needed | Potential Savings Account |

|---|---|---|

| Emergency fund | Instantly | Instant access savings account |

| Holiday savings | In a couple of months | Instant, notice or short fixed term savings account |

| House deposit | In a few years | Fixed term savings account |

Key Insight:

A savings goal can often be better fulfilled with a type of savings account that you wouldn’t expect.

For example, if you’re saving for a house deposit, there may be an instant access account available that offers a higher AER and better flexibility than a fixed term account.

In that case, the instant access account would be the better choice, due to its greater returns and flexibility, despite the fact that traditional wisdom would suggest that a fixed term account is more appropriate.

Understanding Minimum and Maximum Deposit Amounts

Most savings accounts will have a minimum and maximum deposit limit. These limits can be more important than AER in influencing how much deposit interest you’ll earn with one savings account versus another, especially for savers with large amounts of cash.

Minimum Deposit Requirements

The minimum deposit is the lowest amount you can deposit into an account in one go. You want this to be as close to €1 as possible. If the minimum deposit is too high, you might not be able to afford to make a deposit.

Minimum deposits will vary based on the savings product and the offer:

| Product | Minimum Deposit |

|---|---|

| Instant access savings accounts | As little as €1 |

| Notice savings accounts | As little as €1 |

| Fixed term savings accounts | Often €1,000+ but can be as low as €1 |

| Children’s savings accounts | As little as €1 |

| High-yield savings accounts | As little as €1 |

| Credit union savings accounts | As little as €1 |

| State savings | Varies from €0-€50 |

| Money market funds | As little as €1 |

The minimum deposit shouldn’t be confused with minimum monthly deposits or minimum balances.

Minimum monthly deposit is a feature found on certain savings accounts that is intended to encourage regular saving.

Minimum balance is the amount of money you must keep in the account at all times, if any.

The most flexible savings accounts won’t have a minimum monthly deposit or a minimum balance.

Maximum Deposit Caps

The maximum deposit is the highest amount you can deposit into an account in one go. The best savings accounts will have this amount set at €100,000 so that all of your money is protected under the Deposit Guarantee Scheme, meaning there is no risk.

The maximum deposit shouldn’t be confused with maximum monthly deposits or maximum balances.

Maximum monthly deposit is a feature found on certain savings accounts which limits how much money you can deposit each month.

Maximum balance is the maximum amount of money permitted to be deposited in the account in total.

Where a maximum monthly deposit doesn’t exist, the maximum balance and maximum deposit are often, but not always, the same thing.

If the maximum deposit or maximum balance is too low, or if a maximum monthly deposit exists, you might not be able to take full advantage of the advertised AER with all of your money.

Key Insight:

Some savings accounts will have a maximum amount that is eligible to earn the advertised AER. This amount can be different from the maximum balance. If it’s exceeded, the customer will earn a lower interest rate.

Different accounts will apply this rule, where it exists, in different ways. For example:

Account A offers a 2% AER on account balances up to €50,000. If the balance in the account exceeds €50,000, even by a single cent, then a lower AER of 0.01% will apply to the entire balance.

Account B offers a 2.5% AER on account balances up to €40,000. Any deposits in excess of this amount will not be eligible for interest, but the first €40,000 will continue to earn 2.5%.

Account C offers a 3% AER on monthly account balances whose maximum increases by €1,000 each month. For example, €1,000 in month one, €8,000 in month eight and €12,000 in month twelve. After month twelve, the maximum amount eligible for the advertised AER of 3% resets back to €1,000. Where the monthly maximum is exceeded, a lower AER of 0.25% will apply to the excess.

Most savings accounts won’t have this rule and you’ll earn the advertised AER up to the maximum balance of the account. However, where this rule exists, you need to understand how it works and how it will affect the interest that you earn.

Where to Put a Large Sum to Earn the Most Interest

When you’re depositing a lump sum into a savings account, you shouldn’t use an account that has a maximum monthly deposit. You want to be able to deposit the full lump sum on day one so that you can start earning interest on the total balance.

A maximum monthly deposit will prevent you from doing this and you’ll have to slowly drip feed your money into the account each month. This is bad because only part of your money is earning interest while the rest is sitting idle waiting to be deposited.

If your lump sum is more than €100,000, you should consider spreading it out across multiple savings accounts with different banks so that all of your money is covered by the Deposit Guarantee Scheme.

Key Insight:

Provided you have a large enough lump sum to deposit, lower AER savings accounts can earn more interest than higher AER accounts that have maximum monthly deposits.

For example, Sarah has a lump sum of €25,000 sitting in her current account. She wants to deposit this money into a high-yield savings account to earn more interest. Sarah comes across two instant access accounts that she could use.

Account A is with a traditional Irish bank. It offers an AER of 3% with no maximum balance but a maximum monthly deposit limit of €1,000.

Account B is with a German bank. It offers an AER of 2% with a maximum deposit of €100,000 and no maximum monthly deposit limit.

If Sarah chooses Account A, she’ll only be able to deposit a maximum of €1,000 per month into the account. It would take her 25 months to get her full lump sum deposited. As a result, Sarah would only earn €195 worth of interest in year one.

However, if Sarah chooses Account B, she could deposit the full €25,000 lump sum on day one and earn interest on the total balance. After one year, Sarah will have earned €500 worth of interest.

Even though Account B has a lower AER than Account A, it provides over 2.5 times the amount of interest in the first year because it doesn’t have a maximum monthly deposit limit!

Traditional banks regularly promote savings accounts with a high AER to attract new customers. But there’s often a catch. Many of these accounts have a maximum monthly deposit limit as well as other unfavourable terms and conditions that will limit the amount of interest you can earn. Online banks are less likely to do this.

Identify Hidden Fees & Charges

Direct fees on savings accounts are actually quite uncommon, but you need to be on the lookout for hidden costs.

A bank will often charge a monthly or quarterly fee on the current account that you need to set up in order to access the savings account. This is most common with traditional banks, but neobanks also charge fees on certain current account plans that unlock higher AERs on savings.

Many online banks, brokerages and marketplace platforms do not charge savers any fees for using their services. As a clear rule of thumb: the best savings accounts in Ireland will feature minimal or no associated charges.

Evaluate Customer Service and Digital Tools

Customer service quality and digital banking features differ significantly between traditional and online banks.

When choosing a savings provider, you’re often faced with a distinct tradeoff between stability and innovation:

Traditional Banks

Pros

In-person customer support.

High brand awareness.

Full range of financial products.

Cons

Often higher fees and lower AERs.

Poor technology.

Slow processes.

Online Banks

Pros

Higher AERs and lower fees.

Modern user experiences.

Fast onboarding for new customers.

Cons

Remote customer support.

Limited range of financial products.

Less brand awareness.

Key Insight:

While it’s important to be skeptical of new banks and to be vigilant of scammers, if you’re overly cautious towards regulated online banks, you risk missing out on the best savings accounts.

One tip is to use a savings account with an online bank that has a low minimum deposit so that you can get used to holding a small amount of money with them before moving to larger deposits.

Understanding Deposit Interest Retention Tax (DIRT)

Deposit interest retention tax (DIRT) is the tax that Revenue takes from your interest. DIRT is a final tax liability, which means no income tax or USC will be due on the interest once DIRT has been paid, but PRSI may apply.

Some banks will deduct this tax from your interest automatically while other banks won’t. It’s important when comparing savings accounts that you understand whether or not DIRT is being deducted. If it isn’t, you’ll need to declare the interest on your tax return and pay Revenue the tax yourself.

Automatic deduction of DIRT is where the bank takes 33% of your interest and pays it to Revenue before they pay the remaining balance to you. You don’t have to lift a finger, it’s all done for you.

For example, if you earned €100 worth of interest on your deposit, then the bank would retain 33% of that interest (i.e. €33) and pay that amount over to Revenue on your behalf as DIRT. You would therefore receive €67 worth of deposit interest, not €100.

The banks which automatically deduct DIRT from your interest are AIB, Bank of Ireland, PTSB, Revolut, MoCo and State Savings Ireland.

Manual deduction of DIRT is necessary where the bank doesn’t retain 33% of your interest before they pay it out. Using the previous example, you’d receive €100 worth of deposit interest, not €67. In that case, you’d need to declare the €100 interest on your tax return and pay €33 to Revenue as DIRT.

The banks which don’t deduct DIRT from your interest are Raisin Bank, Trade Republic, Bunq and N26.

For more information on DIRT including our DIRT filing guide, exemptions, calculators and more, see our tax on savings accounts page.

Foreign Withholding Tax on European Savings Accounts

Certain savings accounts offered by European banks will deduct an additional tax called withholding tax from your interest. This is not the same as DIRT and shouldn’t be confused with an automatic deduction of DIRT. You’ll still have to pay Irish DIRT even when foreign withholding tax has been deducted by a bank.

Foreign withholding tax can be avoided entirely by selecting a savings account with a bank that doesn’t deduct withholding tax. A bank won’t deduct withholding tax if the tax law doesn’t require them to.

For example, savings accounts with banks based in Germany, Sweden, Norway, Malta, Luxembourg, Italy and France, among others, won’t have foreign withholding tax.

If you deposit with a bank that deducts withholding tax, the rate of withholding tax can often be lowered or even eliminated by providing the bank with details of your Irish tax residence. In most cases, the full amount of foreign withholding tax will be allowed as a credit against your DIRT liability in Ireland. This is known as Double Taxation Relief.

For more information, see our tax on savings accounts page.

Frequently Asked Questions (FAQ)

Yes, European savings accounts are perfectly safe. European banks and their savings accounts are covered by the European Deposit Guarantee Scheme. This means that your deposits are fully guaranteed up to the value of €100,000, even in the highly unlikely event that the bank fails.

Just because a savings account isn’t Irish, doesn’t make it unsafe. Think about all of the people living in Europe who use their national savings accounts every single day!

Yes, European banks are protected the same way as Irish banks. The only difference is the country making the guarantee under the Deposit Guarantee Scheme. For example, deposits with Irish banks are guaranteed by the Irish State whereas deposits with, say, French banks are guaranteed by the French State.

European banks, just like Irish banks, are subjected to strict regulatory supervision by the governing authority. For Irish banks, this would be the Central Bank of Ireland and for, say, German banks this would be BaFin.

If your European bank were to fail, you'd get your deposit back, up to €100,000, within 7 working days.

Yes, there is a way to have all your money protected by the Deposit Guarantee Scheme. To do this, you’ll need to have multiple savings accounts with different banks. You should deposit no more than €100,000 across all accounts with any one bank.

For example, if you have €250,000 to deposit, you could put €100,000 in Bank A, €100,000 in Bank B, and €50,000 in Bank C to have full protection under the Deposit Guarantee Scheme.

However, the more accounts you spread your savings across, the more room there will be for interest and additional deposits to be fully protected.

Yes, you can open a European savings account from Ireland. Today, this process is quite simple and often quicker than opening a savings account at a traditional Irish bank!

To open a European savings account, you’ll need to provide the bank with the usual documentation such as proof of identity, proof of address and PPSN.

The Annual Equivalent Rate (AER) matters because it allows you to compare the actual returns offered by different savings accounts. Every savings account has a ‘gross interest rate’. However, the AER shows your actual return. It takes into account compound interest and how often interest is paid.

In simple terms, two accounts may have the same gross interest rate, but their AERs can differ due to how interest is compounded.

Banks must advertise the AER. This helps customers easily compare real returns.

We classify money market funds (MMFs) as a savings option as they are widely considered to be equivalent to cash. This is because MMFs exclusively invest in highly liquid, low risk assets like bank deposits, government bonds and repurchase agreements.

Strict regulations are in place to ensure that your investment remains stable and can be accessed at any time.

However, money market funds are not savings accounts and don’t qualify for protection under the Deposit Guarantee Scheme. As they are an investment, it’s possible, but highly unlikely, that you may get back less than what you invested.

Deposit Interest Retention Tax (DIRT) isn’t charged on interest earned from money market funds. Instead, Exit Tax at 38% will apply. For more information please see our Money Market Funds page.

Yes, there are savings accounts available with tax benefits in Ireland. Ireland State Savings offers a number of savings products that allow you to earn tax-free, fixed interest with no fees, fully guaranteed by the Irish Government.

Neobanks and online marketplaces usually have the fastest account opening process for savings accounts. This is because they use innovative technologies to perform Know Your Customer (KYC) and ID verification checks instantly. They don’t tend to rely on legacy IT systems or manual paperwork.

Instant access savings accounts, or a fixed term savings account with a short fixed term, would be best for short-term goals in Ireland. This way, you’d strike the right balance between interest and accessibility.

If the short-term goal is building an emergency fund, then an instant access account is the only appropriate choice.

Savings accounts offered by the traditional banks tend to have the best customer service ratings in Ireland. While the savings accounts offered by newer financial institutions are more competitive and technologically advanced, their customer service is still largely remote, which may not suit certain customers.

Yes, there are savings accounts that offer sign-up bonuses and incentives. Certain savings account providers will offer new customers incentives such as higher interest rates, fixed interest rates on instant access accounts or bonus cash if joining from a referral.

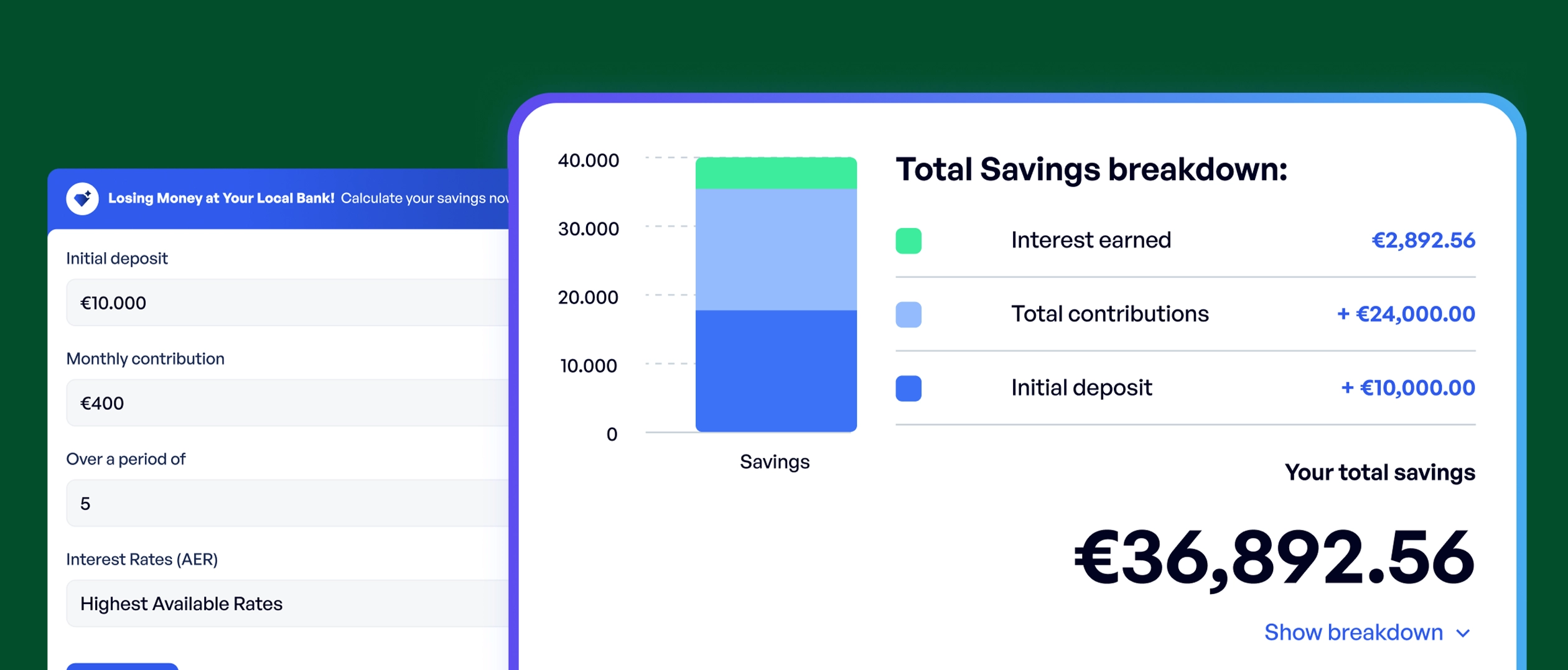

Savings Calculator

Calculate how much you can save over time, and get matched with the best accounts.

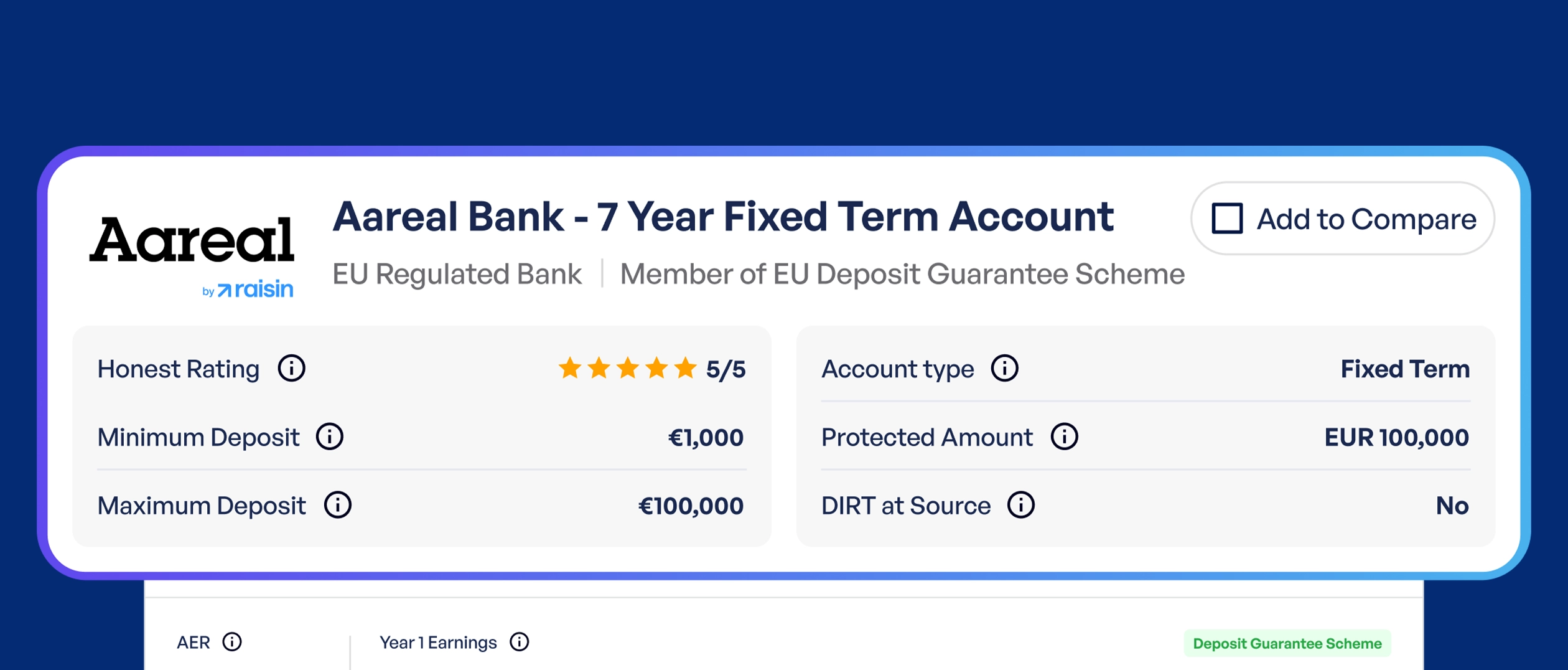

Savings Comparison Tool

Compare over 200 savings accounts side-by-side for detailed analysis.