A Secure Step Beyond Traditional Savings

Money Market Funds

Money Market Funds are a safe, diverse and stable way to earn high interest through a single low-risk investment that keeps your money readily available at all times.

Reading time: 9 min

Last updated: February 4, 2026

Table of Contents:

Written by:

Dan Malone

What is a Money Market Fund?

A money market fund is a type of investment fund that owns low risk assets like bank deposits, government bonds and repurchase agreements. They should not be confused with a money market deposit account or a money market savings account, which are types of savings accounts found in the United States.

How Money Market Funds Work

Money market funds (MMFs) are investment products that offer competitive interest rates, typically higher than traditional bank savings accounts. These investment funds are offered by large asset management companies like BlackRock, JPMorgan and Goldman Sachs and are made accessible to regular investors through online banks and investing platforms.

When you put money into a money market fund, you’re buying shares in the fund. The fund itself uses investor cash to invest in financial assets such as:

Short-term government bonds.

Commercial paper (corporate debt).

Bank obligations.

Put simply, when you invest in a money market fund, you earn interest from Governments, banks and companies who borrow your money. How much you earn depends on the money market rates.

These funds are referred to as ‘cash equivalents’ because they act like physical cash. They are low-risk and low-return investments. They are also highly liquid, so shares in the fund can be easily sold for cash.

Types of Money Market Funds

There are three types of money market funds (MMFs) in Europe:

- 1

Low Volatility Net Asset Value MMFs (LVNAV MMFs).

- 2

Variable Net Asset Value MMFs (VNAV MMFs).

- 3

Public Debt Constant Net Asset Value MMFs (CNAV MMFs).

Most online banks and investing platforms for Irish customers use LVNAV MMFs. These funds must meet strict and highly regulated criteria to ensure that the value of your money within the fund remains constant while earning interest. This stability is achieved by maintaining a constant net asset value (NAV) per share for the fund of €1.00.

LVNAV MMFs must invest in high-quality, short-term assets. These assets should be low risk and have high trading volumes so that you can access your cash whenever you need it.

In layman’s terms, LVNAV MMFs mimic the stability of a traditional bank deposit which is why people see them as similar to cash and as instant access savings products.

How to Choose the Best Money Market Fund in Ireland

In order to choose the best money market funds, you need to be aware of the annual equivalent rates (AERs), sometimes referred to as the annual percentage yield (APY), offered by different funds through different platforms.

You can compare online banks and investing platforms to find the best money market fund rates in Ireland by using our comparison tool.

What are the Benefits of Money Market Funds?

The interest rates offered by MMFs are more competitive than traditional savings accounts, with MMF AERs regularly exceeding the rates attached to the best instant access savings accounts. This makes MMFs a better option, on average, than high-yield savings accounts for low-risk returns.

MMFs invest in short-term debt. This debt is heavily influenced by the European Central Bank’s (ECB) deposit facility interest rate. This means that MMF AERs will be more closely tied to ECB rates than the variable AERs discretionally set by banks on their savings accounts.

MMFs, and LVNAV MMFs in particular, are one of the safest and most stable investments available. The European Union imposes strict regulations on these funds. They offer stable, low-risk returns and keep your cash's value safe.

There has only been a handful of cases in modern history where the net asset value (NAV) per share of a MMF dropped significantly below its stable value of €1/$1/£1. People refer to this as ‘breaking the buck’, and the regulations exist to make sure this doesn’t happen.

MMFs are highly liquid investments which means your shares can be sold and converted back into cash whenever you like.

What are the Drawbacks of Money Market Funds?

The tax rate on money market funds in Ireland is higher than the tax rate on savings accounts. As MMFs are considered investment funds, the interest they pay is liable to 38% Exit Tax (from January 1st, 2026). Interest from traditional savings accounts is liable to Deposit Interest Retention Tax (DIRT) at the current rate of 33%.

Certain online banks, like Revolut, will automatically deduct the Exit Tax from your interest. They then pay it to Revenue for you. Other platforms will not do this, so you will need to declare the interest on your tax return and pay the tax owed to Revenue. Where Exit Tax is automatically deducted, this will be reflected through a lower AER.

Some investing platforms, like Trading 212, use a blend of both bank accounts and money market funds to provide you with the advertised AER on the cash account. In such accounts, the portion of interest that you earn from the bank accounts would be liable to DIRT while the MFFs would be liable to Exit Tax. Always check your platform’s documentation, as they typically provide a percentage breakdown of how your cash is held in the app.

For more information, you can check out our tax on savings accounts page.

You may be wondering if money market funds are insured or protected in Ireland.

MMFs are not bank accounts so they are not protected under the European Deposit Guarantee Scheme. Instead, MMFs receive the same protections as regular investments under the European Investor Compensation Scheme (ICS).

The ICS will provide compensation up to 90% of an investor’s loss, but not more than €20,000, due to a financial services firm’s failure. If the online bank or investing platform failed to safeguard your MMF investments, you could claim under the ICS.

Importantly, the ICS does not compensate investors for losses that come about due to changes in the market value of investments.

Like instant access savings accounts, MMFs offer variable interest rates. The AER on the MMF can go up or down at any time, adding an extra layer of unpredictability to the interest that you’ll earn.

MMFs are more complex than traditional savings accounts, making them less accessible to beginners. But you don’t need to understand every aspect of MMFs to invest in them.

The regulations are there to provide investors with a level of comfort that their money is safe and secure even when the product is not fully understood.

That said, you should always make an effort to understand what you’re investing in and the risks involved before you make any commitment.

As MMFs are investment funds, there are management fees charged by the fund provider. Management fees for MMFs can be in the region of 0.20% but vary depending on the fund. Luckily, the AER/APY includes the fees, so you don’t need to stress about how they affect your returns.

Money Market Fund Providers in Ireland (2026)

The main providers offering high interest rates on cash through a money market account in Ireland are Trading 212 and Revolut. These platforms use the following money market funds to provide you with competitive interest rates on your Euros:

Revolut: Fidelity Institutional Liquidity Fund (Class R Flex Distributing Shares).

Trading 212: BlackRock ICS Euro Liquidity Fund, Goldman Sachs Euro Liquid Reserves Fund and the JPMorgan EUR Liquidity LVNAV Fund.

You can compare money market fund providers in Ireland by using our savings account comparison tool.

Money Market Funds vs. Other Savings Options

The primary alternative to a money market fund is opening a traditional high-yield savings account. It’s important to be aware of the key differences between these two options - specifically regarding protection, liquidity and tax implications.

| Money Market Funds | High-Yield Savings Accounts | |

|---|---|---|

| Access to Funds | Instant Access | Instant, Notice or No Access |

| Interest Rate Type | Variable | Fixed or Variable |

| Tax Rate | Exit Tax - 38% | DIRT - 33% |

| Deposit Guarantee Scheme | No | Yes |

| Investor Compensation Scheme | Yes | No |

Money Market Funds Frequently Asked Questions

When you sell shares in a money market fund, your order will often be processed on the same business day. But since MMFs are traded securities, your online bank or investing platform might set a cutoff time. If you sell after this time, your order may be processed on the following business day.

Highly unlikely. Online banks and investing platforms are regulated financial institutions. They have many protections to keep your investments safe. For example, many financial institutions use ‘asset segregation’. This means your investments are held by a company or a special purpose vehicle (SPV).

This company is separate to the investing platform itself so that, in the event of the platform's failure, your investments would be safe.

However, the actual results of investing in non-Euro MMFs can be worse despite the higher AERs. That’s because when investing in non-Euro assets you need to account for the effects of:

- Foreign currency translation fees

- Losses on foreign currency translation

- Taxes on foreign currency gains

Yes, interest earned from money market funds is liable to Exit Tax in Ireland at a rate of 38%. If this tax isn’t deducted automatically by the online bank or investing platform, you will need to file a tax return to declare the income to Revenue and pay the tax due.

For more information, you can check out our tax on savings accounts page.

Yes, money market funds are very safe. European regulations require these funds to keep your money at a stable value, similar to a regular bank account. Plus, the regulated online banks and investing platforms that make these funds accessible have multiple protections in place to safeguard your investments. If anything goes wrong, you can be compensated for up to 90% of your loss.

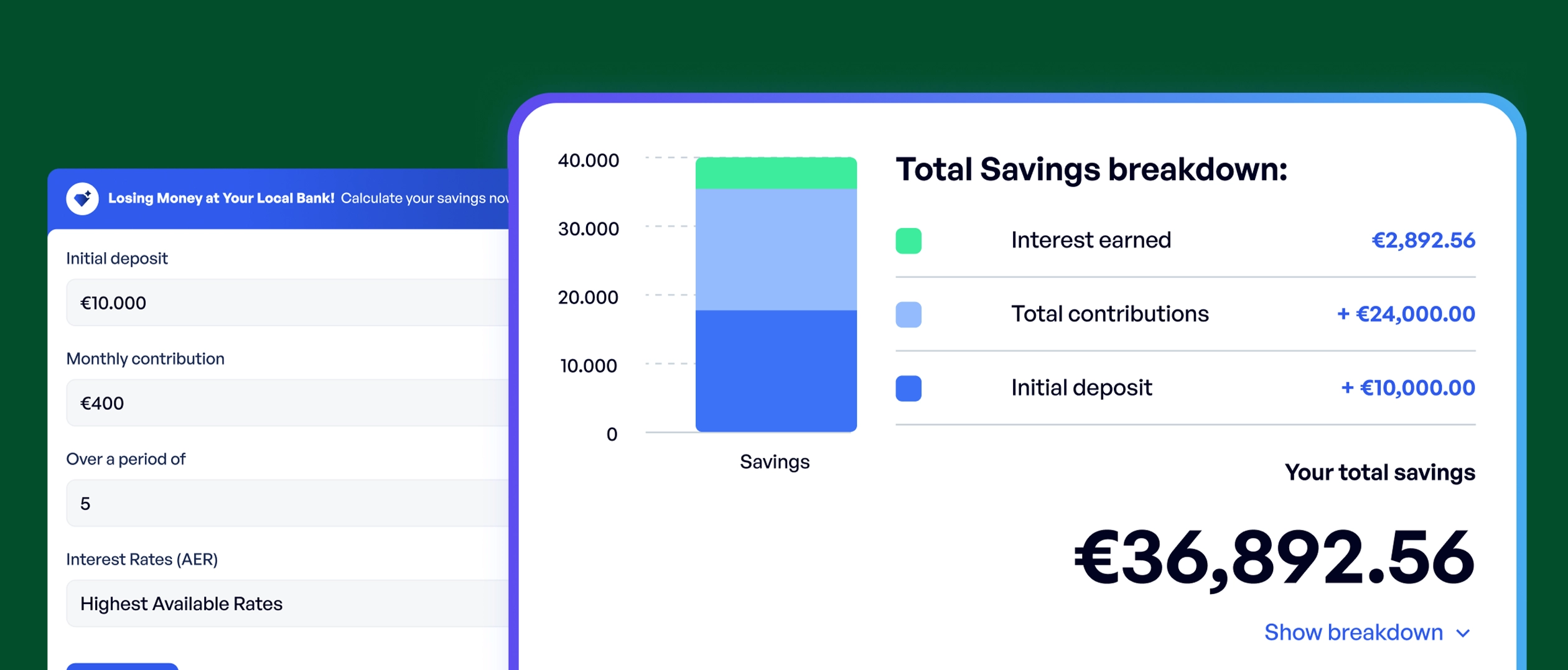

Savings Calculator

Calculate how much you can save over time, and get matched with the best accounts.

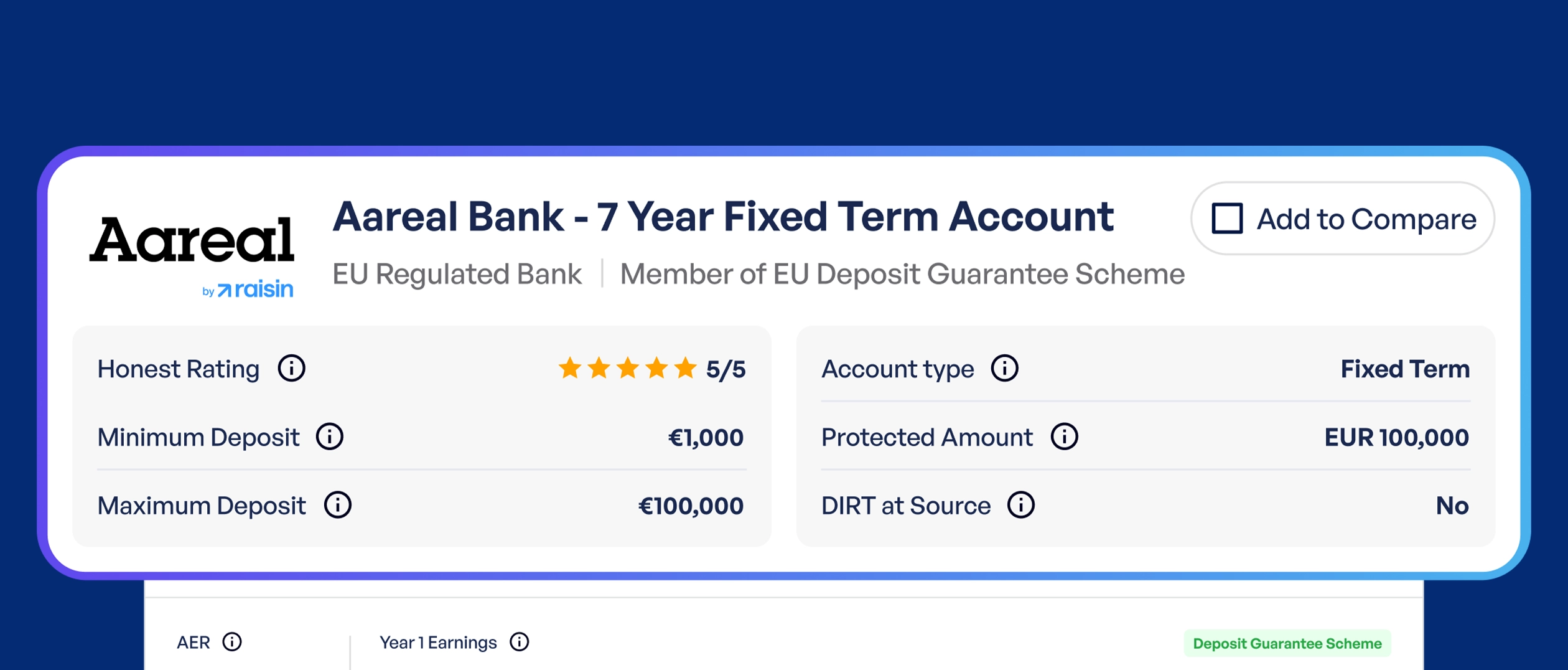

Savings Comparison Tool

Compare over 200 savings accounts side-by-side for detailed analysis.