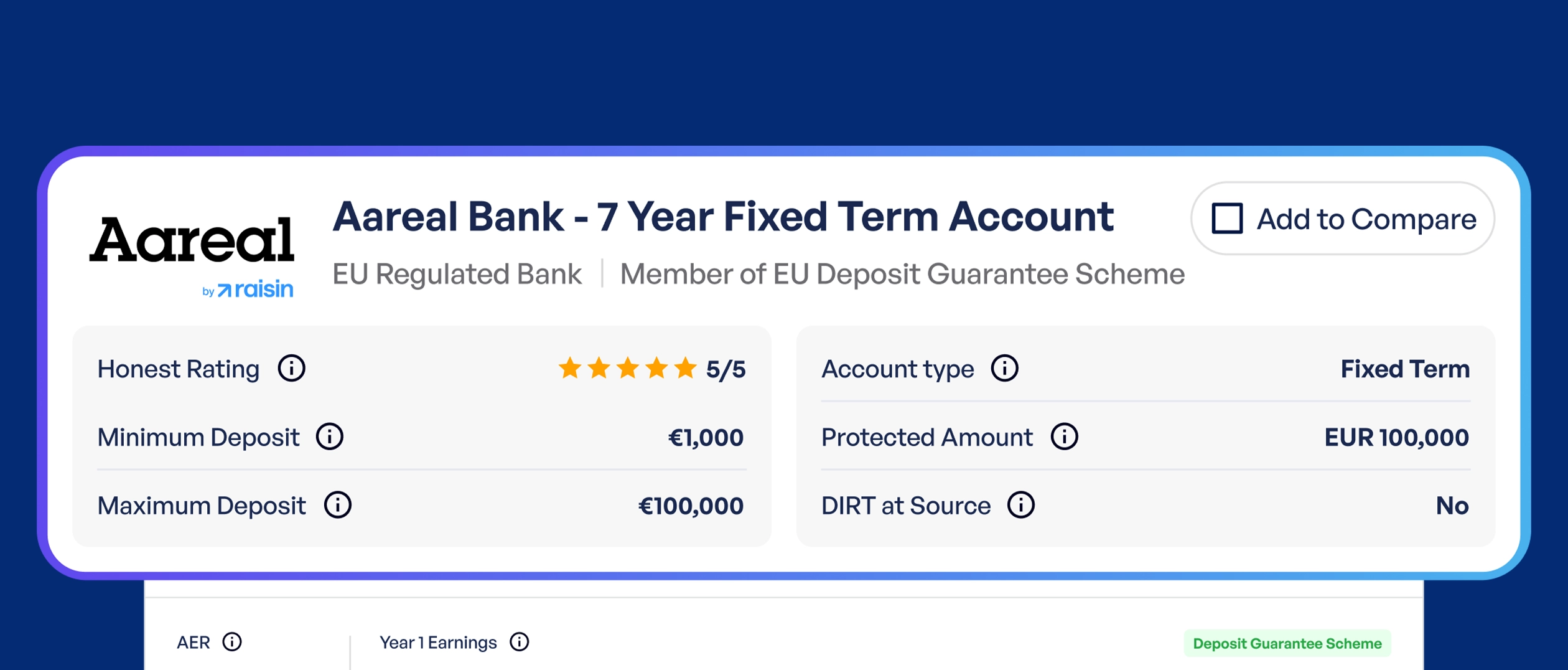

Certain instant access accounts, normally offered by traditional banks, will advertise competitive AERs in a bid to attract new customers. However, under the fine print, you may find terms and conditions that restrict you in your ability to take full advantage of the advertised rate.

For example, one common tactic used by banks is to impose a monthly maximum deposit which limits how much money you can deposit into the account each month to earn the advertised rate of interest. This isn’t ideal for savers who have larger lump sums to deposit right away.

These subtle policies can turn what seems like a market leading instant access account at face value into a mid or even bottom tier savings account.