Savings You Can Plan Around

Fixed Term Savings Accounts

Fixed Term Savings Accounts are a way to earn a guaranteed rate of return on your deposits for a predetermined amount of time.

Reading time: 7 min

Last updated: February 4, 2026

Savings You Can Plan Around

Fixed Term Savings Accounts are a way to earn a guaranteed rate of return on your deposits for a predetermined amount of time.

Reading time: 7 min

Last updated: February 4, 2026

Written by:

Dan Malone

A fixed term savings account, also known as a fixed term deposit account, is a type of savings account that locks up your money for an agreed period of time (the ‘fixed term’) in return for a guaranteed rate of interest (the ‘fixed rate’).

When you deposit money, the bank makes a commitment to provide you with the advertised annual equivalent rate (AER) until the end of the term. Locking in a guaranteed deposit interest rate is a key benefit of these accounts, which can be particularly valuable at times when interest rates are high or expected to fall.

In return, you commit to not withdrawing your money until the term expires. This makes fixed term savings accounts the least flexible type of savings account available.

The fixed term can be as short as three months or as long as seven years, depending on the savings account.

Because the bank knows they won’t have to return the deposit for an agreed period, they can offer higher deposit interest rates on fixed term savings accounts. Longer fixed terms tend to come with higher interest rates than shorter fixed terms, but not always.

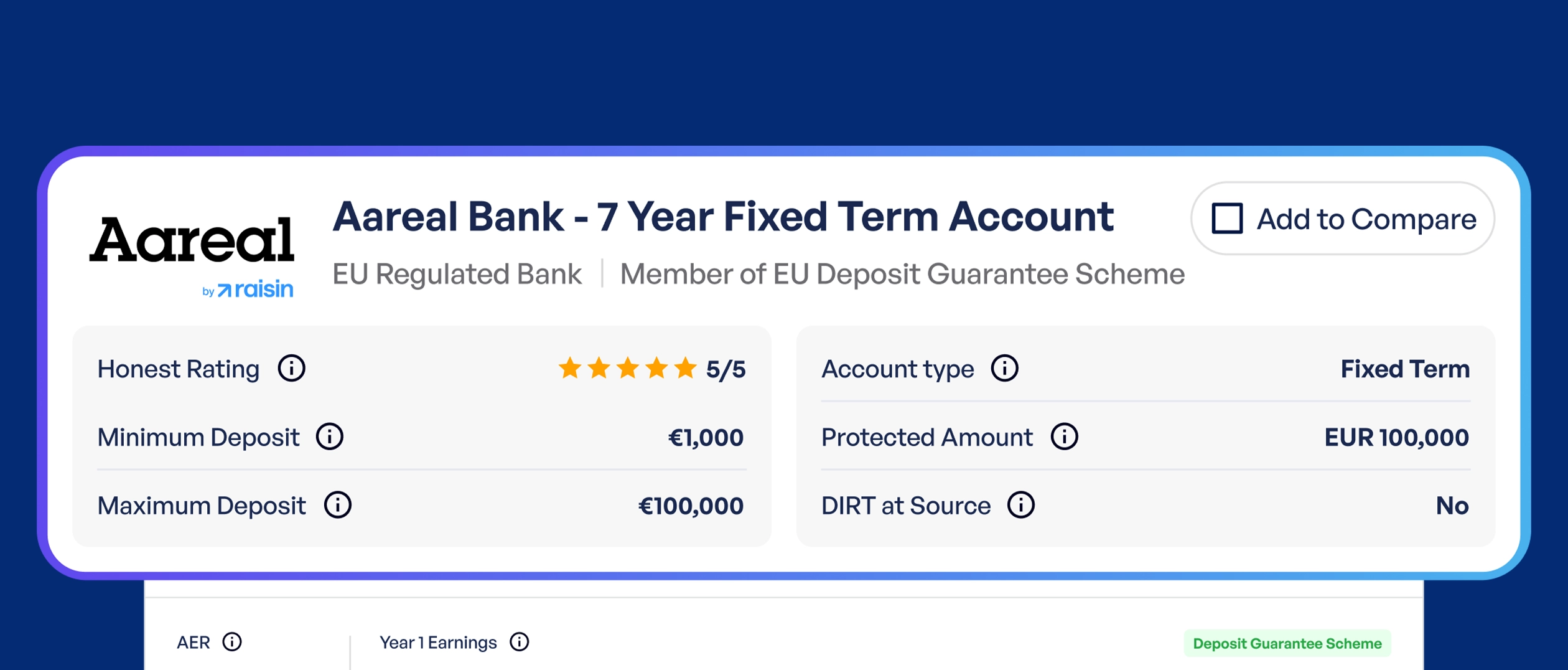

Choosing the best fixed term deposit account depends on your personal financial goals for the money at hand. You need to strike the right balance between AER, fixed term duration and minimum deposit.

You can compare accounts to find the best fixed term deposit rates in Ireland by using our comparison tool.

Fixed term savings accounts tend to offer higher deposit interest rates than instant access or notice accounts, especially when comparing accounts offered by the same bank. The higher the interest rate, the more money you’ll earn on your savings, all else being equal.

Fixed term savings accounts are designed to store money that won’t be needed for a known period of time. Once they’re deposited, the savings can’t be accessed until the end of the fixed term.

Knowing when you will and won’t need access to your money is a powerful advantage. It lets you take on fixed interest rates without the worry of whether you’ll have enough cash on hand in the future.

Fixed term savings accounts come with fixed deposit interest rates which can’t be increased or decreased during the fixed term. Banks tend to adjust their savings account rates based on the European Central Bank’s decisions about Eurozone interest rates.

It’s impossible to accurately predict when rates will change, which adds uncertainty to the interest that savers will earn when they’re earning a variable rate instead of a fixed rate.

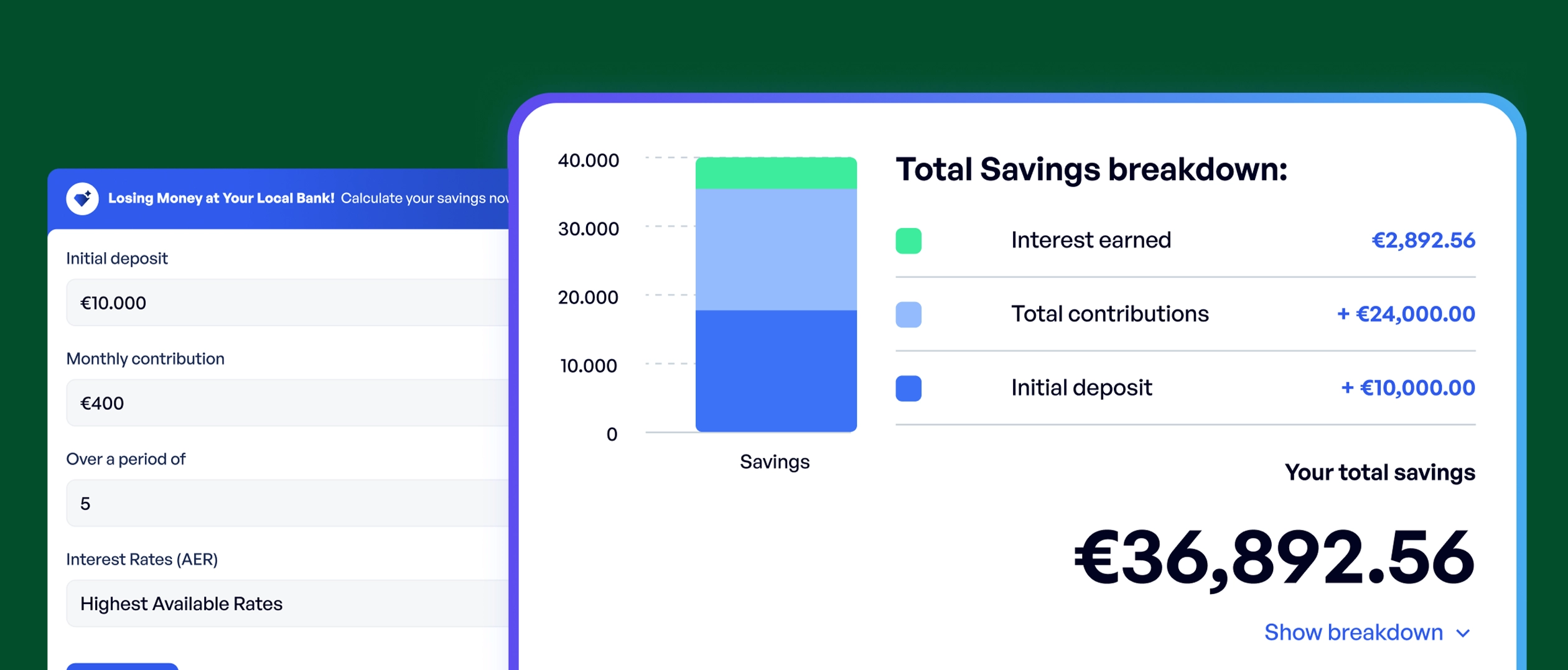

Fixed rates make it really easy to work out exactly how much interest you’ll earn on your savings. You can use our savings calculator to see how much interest you’d earn in a fixed term savings account.

Money deposited into a fixed term savings account becomes inaccessible until the end of the fixed term advertised on the account. If it’s a 3 year fixed term account, then your money is inaccessible for 3 years. This can be a problem if you need it before then, which is why it’s important to be sure that you won’t.

Keeping enough money in an instant access account can help you avoid tricky financial situations when you need cash. That said, life is unpredictable. You need to be willing to accept the risk of needing funds you cannot immediately access before committing to a long-term deposit.

Fixed term savings accounts are intended for a single lump sum payment. Once the first deposit has been made, it’s not possible to make additional deposits to the same account. That’s because part of the deal is that you make the commitment with a lump sum at a point in time.

If top-up deposits were allowed, the bank would be on the hook to pay you the agreed fixed rate on your future deposits, even if market rates fall. Not exactly fair.

If you want to add more money to a fixed term savings account after your first deposit, you can either open a new account with the same bank or explore other banks for better rates.

Watch out if you have over €100,000 deposited across more than one savings account with a single bank as any excess won’t be covered by the deposit guarantee scheme.

Fixed-term savings accounts offer certainty about your interest earnings as well as downside protection against falling rates. However, they stop you from benefitting from rising interest rates.

If the bank increases interest rates on the same fixed term account after you deposit, you won’t benefit from the higher rate on the money you’ve already added. Instead, your deposit will continue to earn the previously agreed interest rate until the fixed term ends. If you want to enjoy the updated, higher fixed rate, you’ll need to make a new deposit with the same bank.

This is the classic risk/reward trade-off of fixed term accounts. If you deposit too much at once, you run the risk of not having cash on hand to take advantage of better opportunities that might arise.

Fixed term savings accounts have higher minimum deposit requirements on average than instant access and notice accounts making them less accessible.

The main fixed term deposit providers in Ireland are Raisin Bank, PTSB, AIB, Bank of Ireland and State Savings.

You can compare fixed term savings account providers in Ireland by using our comparison tool.

The alternative to a fixed term savings account is either an instant access account or a notice account. It’s important to be aware of the differences when you compare fixed term savings accounts as another type of savings account might be more appropriate for your financial goals:

| Fixed Term Accounts | Notice Accounts | Instant Access Accounts | |

|---|---|---|---|

| Access to Funds | No access | Access with notice | Instant access |

| Minimum Deposit Level | High | Medium | Low |

| Interest Rate Type | Fixed | Variable | Variable |

| Interest Rate Level* | High | Medium | Low |

*when comparing accounts offered by the same bank

You have to keep your money in a fixed term account until the end of the fixed term, which can be as short as three months or as long as seven years depending on the account.

Yes, a fixed term savings account can be a good option as a mortgage savings account, especially if you already have a cash lump sum ready to deposit.

However, you need to take care in selecting an account that has an appropriate fixed term which lines up with when you’re aiming to use your deposit to purchase a property.

No, you can’t withdraw your money early from a fixed term savings account. Certain accounts may allow you to withdraw a portion of your deposit, but this isn’t common.

Some accounts will only pay out interest at the end of the fixed term while others will pay out interest annually. If you have the choice, it’s better to keep the interest in the account so that it can earn interest of its own, where permitted. This is called compound interest.

When the fixed term ends your deposit is returned to you along with any interest that remains to be paid.

However, it’s important to check the terms and conditions of the account as some banks may automatically reinvest the deposit and interest earned for another fixed term unless you tell them otherwise.

Calculate how much you can save over time, and get matched with the best accounts.

Compare over 200 savings accounts side-by-side for detailed analysis.

Join our monthly newsletter →

Stay informed with practical insights on all money decisions in Ireland.

“Honest was created to provide regular people with expert financial resources, specifically designed for the Irish market. High-quality, trusted financial information has been gatekept for too long. We’re putting it all out on the table, clearly and without bias.”

Dan Malone | Founder

View Profile

© 2026 • All rights reserved • Honest is a publisher and a technology platform that does not provide financial advice • All information provided by Honest is for educational purposes only and should not be construed as financial advice • Honest does not take your specific needs, objectives or financial situation into consideration, and any products mentioned may not be suitable for you • You should always carry out your own independent research before making any financial decisions and consult a qualified financial advisor if you’re unsure • Honest cannot guarantee the accuracy or completeness of the information published, which is subject to change at any time without notice • Honest does not provide regulated advice or personalised recommendations • Honest Media Limited is not regulated by the Central Bank of Ireland • View privacy policy

By joining the Honest newsletter, you will be able to stay up to date with everything going on in the world of Irish personal finance.

By joining the Honest newsletter, you will be able to stay up to date with everything going on in the world of Irish personal finance.

By joining the Honest newsletter, you will be able to stay up to date with everything going on in the world of Irish personal finance.

By joining the Honest newsletter, you will be able to stay up to date with everything going on in the world of Irish personal finance.

By joining the Honest newsletter, you will be able to stay up to date with everything going on in the world of Irish personal finance.

We’re building a better way to manage money in Ireland Investments, Pensions, Insurance and Banking.

Join our newsletter for updates on Honest products.

We’re building a better way to manage money in Ireland Investments, Pensions, Insurance and Banking.

Join our newsletter for updates on Honest products.

Get our free monthly Money Tips email!

Stay informed with practical insights on all money decisions in Ireland.

Get free monthly Money Tips!

Stay informed with practical insights on all money decisions in Ireland.