A Guide to Member-Based Savings Accounts

Credit Union Savings Accounts

Credit Union Savings Accounts are a way to save money, help your community and become a part of an organisation that’s run by its members, for its members.

Reading time: 12 min

Last updated: December 15, 2025

Table of Contents:

Written by:

Dan Malone

What is a Credit Union Savings Account in Ireland?

A credit union savings account is an alternative to a traditional savings account. When you deposit in a credit union account, you’re lending money to your community. Credit unions are owned by its members, and because members must be part of the community, your deposits are lent out locally.

How Credit Union Savings Work

Credit unions are not-for-profit, community-driven organisations. When you save, you become a member of that branch. Any income that the credit union makes from lending to the community will either be returned to its members or used to improve the services offered.

Credit union savings work differently to regular bank savings. Instead of paying you interest, a credit union will pay out a portion of the profits that the union makes to all of its members. This is known as a dividend. A credit union savings account interest rate will apply to Fixed Term Deposit Accounts, Notice Accounts and CU Cash Accounts, but not Share Accounts.

- The amount of dividend you receive depends on how many shares in the credit union you own.

- When you deposit money, you receive one share for every €1 deposited.

This creates an element of unpredictability for your income: If the credit union makes a profit, it will pay you a dividend for each share you own. If there is no profit, there will be no dividend. Where a profit is made, there’s said to be a ‘credit union surplus’.

A credit union may sometimes choose to use its surplus to pay out a ‘loan interest rebate'. This refunds a portion of the interest that members of the credit union paid back when they borrowed money.

How to Join a Credit Union

To join a credit union, you must have a ‘common bond’ with the credit union and its members. Your common bond is typically the area where you live, work or study.

This is to ensure you have a genuine connection with the community the credit union serves, so that members know their savings are being lent out locally.

Example: to join Capital Credit Union, you must live, work or study in Dublin 2, 4, 6, 6W, 8, 12, 14, 16, 18 or North Wicklow.

Once your common bond is established, you can open a credit union account by providing:

- Proof of identity: Your passport or driver’s license.

- Proof of address: A utility bill, official government document or bank statement.

- Proof of PPSN: A document or letter from Revenue or the Department of Social Protection.

How Safe Are Your Savings in a Credit Union Account?

Credit unions must be authorised to provide financial services to their communities by the Central Bank of Ireland. This means that all credit unions in Ireland are fully regulated and subject to strict supervision.

Credit union savings accounts are covered by the Irish Deposit Guarantee Scheme (DGS), meaning all of your eligible savings with the credit union are safe and secure up to €100,000, even if the credit union were to fail.

In addition to protection under the DGS, the Irish League of Credit Unions (ILCU), which is the representative body for credit unions in Ireland, operates a Savings Protection Scheme (SPS). This scheme is designed to provide financial support and stability to struggling credit unions.

All of these protections make your savings very safe in a credit union account.

What Are the Benefits of Credit Union Savings Accounts?

1. Life Savings Cover

Credit unions offer special insurance to members, which sets them apart from regular banks. Some of this insurance is free of charge, while other policies cost extra. Life savings cover is a free insurance policy provided by all ILCU affiliated credit unions to their members.

How it works: When a credit union member dies, a bonus payment will be made to their estate or nominated beneficiary on top of the savings in the member’s account.

The bonus payment will be calculated in one of two ways depending on the credit union:

A. Age of Lodgement (Most Preferred Method)

Under this policy, deposits you make to your credit union account, earn you an amount of insurance, based on your age at the time the lodgment was made:

| Age | Every €1 Deposited Earns You |

|---|---|

| From 0-54 | €1 of insurance (100%) |

| From 55-59 | €0.75 of insurance (75%) |

| From 60-64 | €0.50 of insurance (50%) |

| From 65-69 | €0.25 of insurance (25%) |

| From 70+ | €0.00 of insurance (0%) |

Important to note: The insurance value at lodgement is fixed and paid at death, provided you keep your savings in the credit union. Most credit unions cap the maximum payout, typically between €3,000 and €13,000. If your earned insurance is more than the limit, then the limit will be paid out.

Withdrawing money from your share account, especially later in life, will reduce your bonus. To protect the bonus, many credit unions will guide older members towards taking a Secured Loan against their deposits if they need cash. This way, they avoid withdrawing funds.

| Age | Age-Related Cover Rate | Member Action | Impact on Bonus Payment | Bonus Payment Balance | Savings Account Balance |

|---|---|---|---|---|---|

| 53 | 100% | Deposit €5,000 | +€5,000 | €5,000 | €5,000 |

| 70 | N/A | Passes Away | N/A | €5,000 | €5,000 |

Earl will receive a total payment of €10,000 from John’s credit union, made up of a share account balance of €5,000 and a life savings insurance payment of €5,000.

| Age | Age-Related Cover Rate | Member Action | Impact on Bonus Payment | Bonus Payment Balance | Savings Account Balance |

|---|---|---|---|---|---|

| 31 | 100% | Deposit €12,000 | +€12,000 | €12,000 | €12,000 |

| 71 | 0% | Withdraw €5,000 | - €5,000 | €7,000 | €7,000 |

| 75 | 0% | Deposit €5,000 | Nil | €7,000 | €12,000 |

| 76 | N/A | Passes Away | N/A | €7,000 | €12,000 |

Sarah’s estate will receive a total payment of €19,000 once grant of probate has been obtained. Although Sarah deposited €5,000 before her death, she was over 70. So, the deposit didn’t qualify for extra life savings insurance.

The withdrawal of €5,000 at age 71 cost Sarah’s estate €5,000 worth of insurance.

Important Tip: Instead of withdrawing, Sarah could have borrowed €5,000 from her credit union and pledged her shares as collateral to get a lower interest rate. The total interest on the loan would have been far lower than the €5,000 in lost insurance.

Michael opens a credit union account at age 40 and deposits €10,000. He withdraws €4,000 at age 56, deposits €4,000 at age 60 and passes away at age 75. Michael nominates his best friend Fiona to receive his credit union savings.

| Age | Age-Related Cover Rate | Member Action | Impact on Bonus Payment | Bonus Payment Balance | Savings Account Balance |

|---|---|---|---|---|---|

| 40 | 100% | Deposit €10,000 | +€10,000 | €10,000 | €10,000 |

| 56 | 75% | Withdraw €4,000 | - €4,000 | €6,000 | €6,000 |

| 60 | 50% | Deposit €4,000 | +€2,000 | €8,000 | €10,000 |

| 75 | N/A | Passes Away | N/A | €8,000 | €10,000 |

Michael’s withdrawal of €4,000 reduces his previously earned insurance down to €6,000. His additional deposit of €4,000 at age 60 qualifies for a bonus of 50% (€2,000), bringing the total bonus up to €8,000.

Fiona will receive the insurance bonus of €8,000 and the credit union account balance of €10,000 for a total payment of €18,000.

Aoibheann opens a credit union account at age 66 and deposits €10,000. She later withdrew €8,000 before passing away at age 70. Aoibheann had no nominated beneficiaries and no will.

| Age | Age-Related Cover Rate | Member Action | Impact on Bonus Payment | Bonus Payment Balance | Savings Account Balance |

|---|---|---|---|---|---|

| 66 | 25% | Deposit €10,000 | +€2,500 | €2,500 | €10,000 |

| 67 | 25% | Withdraw €8,000 | - €2,000 | €500 | €2,000 |

| 70 | N/A | Passes Away | N/A | €500 | €2,000 |

As Aoibheann was 66 years old when she deposited, her savings of €10,000 only qualified for a 25% bonus payment (€2,500) . When she later withdrew €8,000, this reduced her insurance bonus by €2,000 (25% of the withdrawal) , leaving her with only a €500 bonus.

Aoibheann died intestate (without a will). Her estate will get €2,500 once letters of administration have been obtained (i.e. Account Balance of €2,000 + Bonus of €500).

B. Age at Death (Least Preferred Method)

Under this policy, the amount of insurance you earn depends on your age at the date of death and the balance in your credit union account:

| Age at Death | Insurance Bonus |

|---|---|

| 0-54 | 100% |

| 55-59 | 75% |

| 60-64 | 50% |

| 65+ | 25% |

- Some credit unions will apply a cover limit to cap the balance that the insurance bonus can be calculated against.

- Some credit unions will calculate your insurance bonus based on the lowest balance that the account reached after age 70.

Both of these rules have the effect of significantly reducing your insurance payout.

Barry died at age 61 with €8,000 saved in his credit union account. His credit union has a cover limit equal to €5,000 for life saving insurance. Barry nominated his sister Claire to receive the cash.

Claire will receive the €8,000 balance in the credit union account plus a bonus payment of €2,500 (i.e. €5,000*50%) - resulting in a total payment of €10,500.

Margaret had €10,000 at age 69. When she was 71, she withdrew €8,000 to go on a holiday, leaving her with a balance of €2,000. She recovered her balance back up to €7,000 a few years later, before passing away at age 80. Margaret nominated her neighbour Tommy to receive the cash in her account.

Her credit union has a cover limit of €3,000 and calculates the bonus based on the lowest balance after age 70. As Margaret’s balance reached a low of €2,000, that’s the amount that will be used to calculate her insurance. Margaret’s insurance bonus is €500 or €2,000*25%.

Tommy will receive the €7,000 balance in the credit union account plus a bonus payment of €500 - resulting in a total payment of €7,500.

2. Account Nomination

Credit union savings accounts allow you to nominate a person that will receive the savings in your account when you pass away, up to a specified limit. This includes life savings insurance. The current limit is €27,000. This is made possible by Section 21 of the Credit Union Act 1997.

You can nominate anybody you like to receive this money. The benefit of doing this is that the nominated funds won’t form part of your estate. This means that the nominated person can access that money right after you die. They won’t have to wait for the executors of the estate to obtain a grant of probate or letters of administration. This saves months of waiting.

The nominated person will need to pay Capital Acquisitions Tax (CAT) on the funds received, if applicable.

What Are the Drawbacks of Credit Union Savings Accounts?

Credit unions are not obligated to pay dividends. This is fundamentally different from traditional bank accounts where the bank is legally obligated to pay you the advertised AER as interest. Therefore, there’s no guarantee that you’ll receive a dividend for the shares that you own in the credit union. You will only receive a dividend if the credit union has profit to distribute.

As credit union membership requires you to have a common bond with the area that the credit union serves, you may not be able to join the branch that you want. One credit union may be more profitable than another, increasing the chance and size of a dividend.

Equally, some credit unions will have lower loan rates, higher life savings insurance caps and larger maximum deposits than others. You want to be with the best branch possible but you can’t always control which branch(es) you have a common bond with.

You may not be able to withdraw some or all of your money from a credit union savings account if you have pledged that money as collateral against a credit union loan. A credit union may offer you lower interest rates on loans if you agree that they can claim your shares (your deposits) if you fail to repay the loan.

For older members, protecting a life savings cover bonus makes sense. But for younger members, not being able to access savings could mean missed opportunities elsewhere or being caught out by a financial emergency.

Credit Union Savings Accounts Frequently Asked Questions

Yes, credit unions can double your savings when you pass away through a Life Savings Cover bonus payment. Life Savings Cover is a free insurance policy offered by all ILCU affiliated credit unions.

However, it’s not a guaranteed way to double your savings. Your bonus can depend on your deposits and withdrawals, your account balance, your age at death and the bonus limit set by the credit union.

Yes, credit union dividends are taxed under Deposit Interest Retention Tax (DIRT) at the current rate of 33%. This will be automatically deducted from your dividend by the credit union.

Yes, you will need to hold between one and ten shares when joining a credit union in Ireland. That means the minimum deposit is between €1-€10.

Credit unions set different maximum deposit limits. These can range from €15,000-€100,000. For children’s accounts, the maximum deposit will be lower, often between €5,000-€15,000.

Some credit unions also set a weekly or monthly maximum deposit. This is separate from the total amount you can save in the account.

Yes, credit union savings are instantly accessible. But, some credit unions limit daily or weekly withdrawals - this applies to cash, electronic funds transfer (EFT), or both.

Yes, even if your credit union shares are pledged they still earn dividends. The insurance bonus they generated will remain intact.

Yes, besides popular Share Accounts, a credit union can also offer Fixed Term Deposit Accounts, Notice Accounts and CU Cash Accounts. Deposits in a CU Cash Account are instantly accessible and can be withdrawn in full even if you have an outstanding loan with the credit union.

The ILCU has its own insurance company, ECCU Assurance DAC. It offers insurance products to credit unions in Ireland for their members. ECCU Assurance DAC is regulated by the Central Bank of Ireland.

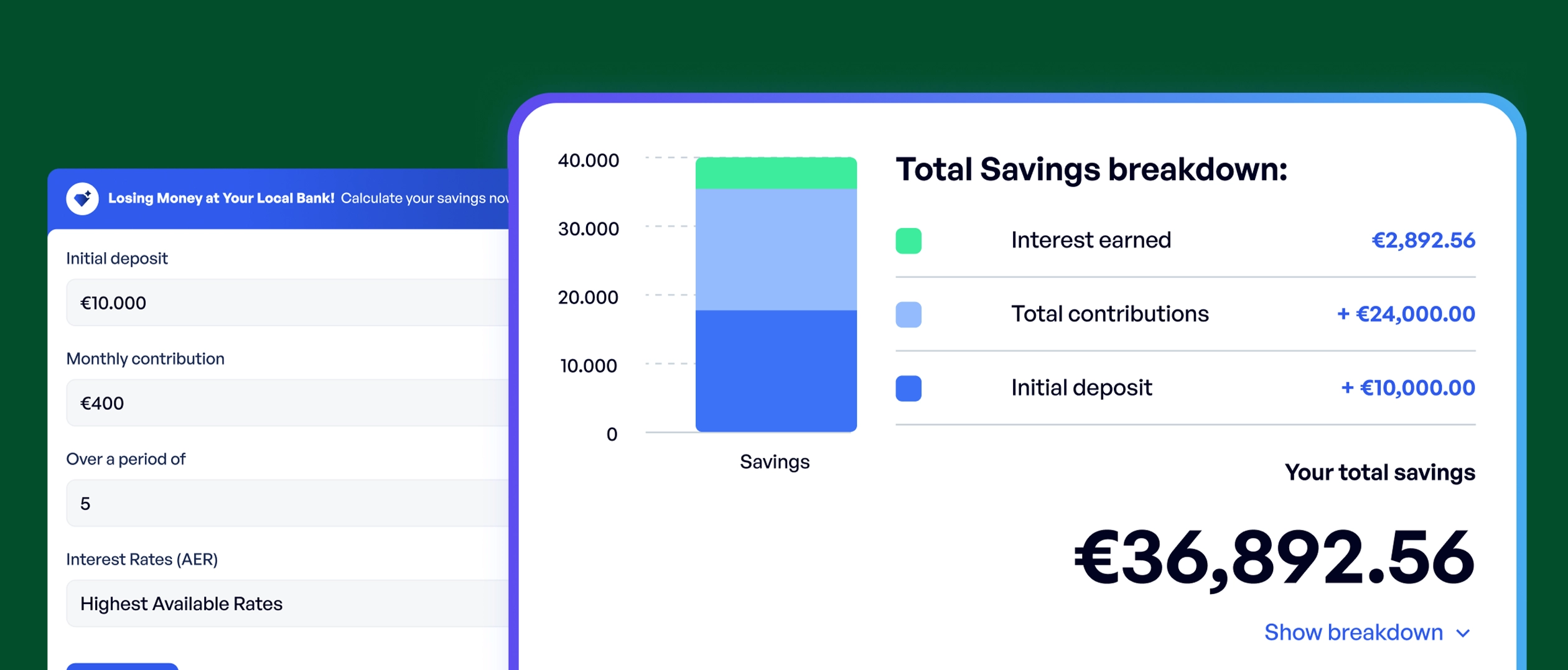

Savings Calculator

Calculate how much you can save over time, and get matched with the best accounts.

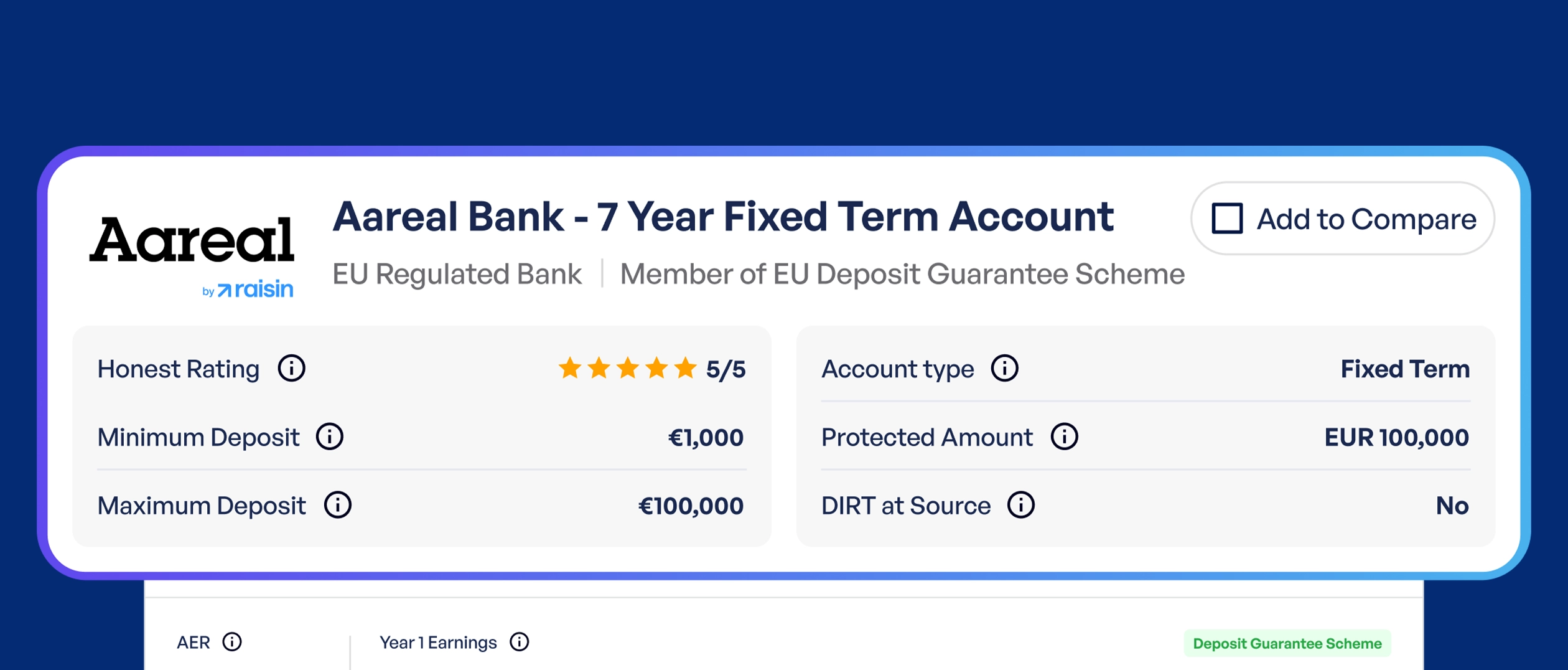

Savings Comparison Tool

Compare over 200 savings accounts side-by-side for detailed analysis.