State Savings is the brand name for the savings products offered by the Irish government, sometimes referred to as national state savings. These products are not the same as traditional savings accounts. The main difference is that, with State Savings, you’re lending money to the Irish government, not a bank.

The money that the government raises from these products adds to Ireland’s national debt. Irish households have more than €19 billion saved with the government, accounting for over 8% of the country’s total debt.

The Irish government must repay the money you’ve saved with these savings products since they are part of the national debt. The government has the same obligation to individuals, corporations and foreign nations that purchase Irish government bonds to help fund the country’s public spending.

It’s this obligation that makes Ireland State Savings a true risk-free savings option. Ireland has an AA credit rating from Standard & Poor’s - there is no doubt on the government’s ability to meet their repayment obligations.

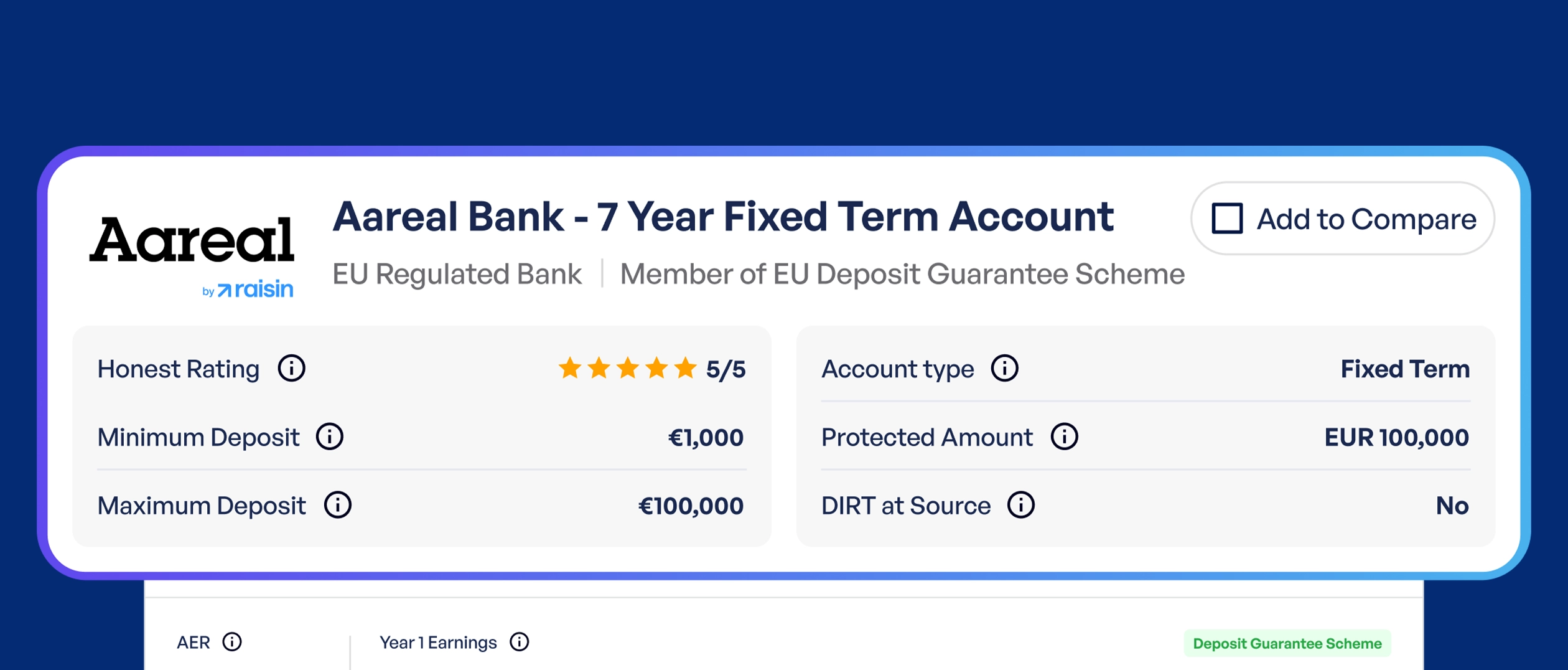

Unlike the Deposit Guarantee Scheme, which protects deposits in traditional savings accounts up to €100,000, the Irish government guarantee that applies to State Savings has no monetary limit. This means you can save as much as permitted without fearing something going wrong.