![]() High-Yield Deposit Accounts

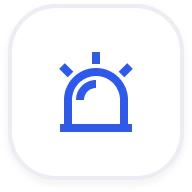

High-Yield Deposit Accounts

Today’s Top Savings Rates

Discover the highest AER accounts with a 5-star Honest transparency score. To see all accounts, check out the comparison tool.

![]() Savings Account Types

Savings Account Types

Types of Savings Accounts

Find the right savings account for your financial goals. Each account type offers unique benefits to help you save smarter.

Instant Access Accounts

Access your money whenever you need it and earn competitive interest rates with complete flexibility.

Fixed Term Accounts

Lock in a guaranteed rate for a set period. Ideal for medium and long-term savings goals.

Money Market Funds

Earn high interest with instant access when you need it with these ultra-low risk investments.

![]() Savings Account Types

Savings Account Types

Types of Savings Accounts

Find the right savings account for your financial goals. Each account type offers unique benefits to help you save smarter.

Instant Access Accounts

Access your money whenever you need it and earn competitive interest rates with complete flexibility.

Fixed Term Accounts

Lock in a guaranteed rate for a set period. Ideal for medium and long-term savings goals.

Money Market Funds

Earn high interest with instant access when you need it with these ultra-low risk investments.

![]() FAQ

FAQ

Frequently Asked Questions

Honest helps you to find the best savings accounts and strategies for maximizing your return.