Savings Account Protection

Deposit Guarantee Scheme

Knowing how your savings are protected, both in Ireland and abroad, is a must. If you don’t know the safety rules that apply to all European banks, you’ll be skeptical about choosing one that isn’t Irish.

Reading time: 13 min

Last updated: January 15, 2026

Table of Contents:

Written by:

Dan Malone

The truth is, most people trust their bank because they’re familiar, not because they understand the laws that keep their money safe. Understanding this will give you the confidence to always take advantage of the best accounts, even if they’re not with an Irish bank.

How Savings Accounts Are Protected

Savings accounts are protected by a European Union (EU) Directive called the Deposit Guarantee Scheme (DGS). The DGS ensures your money is protected if the bank, credit union, or building society fails. Every country in the EU must have a DGS. If a bank fails, it’s the country’s responsibility to guarantee the savings of the bank’s depositors, no matter where they live.

The DGS is harmonised across the EU, meaning every country offers the same guarantee. This makes European banks just as safe as Irish banks for Irish savers.

Key Insight:

The Deposit Guarantee Scheme applies only to regulated credit institutions like banks and credit unions. Never send money to a company without checking that they’re regulated first. Honest will only display savings accounts offered by regulated banks.

€100,000 Guarantee Limit

Savings up to €100,000 per bank are protected under the DGS. That’s €100,000 total across all accounts with the same bank - it’s not a per-account guarantee.

If you have less than €100,000 deposited with a single bank, all of your money will be returned if the bank fails.

If you have more than €100,000 deposited, the most you’ll get back is €100,000.

That’s why it’s a good idea to spread out your savings across different banks if you’re planning on keeping more than €100,000 on deposit. That way, you can have all your money insured by the DGS.

If you have a joint bank account, the DGS covers the account up to €200,000 with each account holder being entitled to 50% of the DGS payout (i.e. a maximum of €100,000 each).

The 7 Working Day Promise

If deposits from a bank become unavailable, customers are legally entitled to get their money back within 7 working days of the bank’s failure.

Temporary High Balances

Certain qualifying deposits are protected under the DGS up to €1,000,000 for 6 months after lodgement. This protection covers people who deposit or receive a large amount of money when their bank fails.

If the person doesn’t fully control the deposits, the 6 month clock only starts when they gain that control. This is common with money relating to inheritances and court orders.

For the money to be considered a qualifying deposit, it must relate to:

This includes:

- Money received from selling a home.

- Money deposited to purchase a home.

- Money received from an equity release loan.

Life events include marriage, civil partnership, divorce, retirement, dismissal, redundancy, invalidity and death. Examples could include:

- A cash gift received as part of a marriage or civil partnership.

- A financial settlement received through divorce proceedings.

- A lump-sum payment received from an occupational pension scheme or personal retirement savings account.

- A severance package or unfair dismissal compensation paid by a former employer.

- An insurance payout for serious illness.

- An inheritance.

Key Insight:

Unlimited cover is provided for 6 months for personal injury compensation amounts. The €1,000,000 limit does not apply.

This includes:

- Life assurance or serious illness/disability insurance payouts.

- Compensation for criminal injuries.

- Compensation for wrongful conviction.

How Does The Deposit Guarantee Scheme Work?

Not all deposits are eligible for the Deposit Guarantee Scheme. The guarantee only applies to Covered Deposits, which are deposits held by:

- Individuals.

- Sole traders.

- Partnerships.

- Clubs, associations, schools and charities.

- Companies.

- Solicitors holding client funds.

- Small-self administered pensions (SSAPs).

The guarantee doesn’t apply to Uncovered Deposits, which are deposits held by:

- Banks, credit unions and building societies.

- Money laundering offenders, charged or pending decision.

- Financial institutions.

- Investment firms.

- Depositors who haven’t been identified under anti-money laundering (AML) rules.

- Insurance and reinsurance firms.

- Collective investments schemes.

- Public authorities.

- Pension schemes, other than SSAPs.

- Debt securities issued by banks.

At the end of 2024, Covered Deposits in Ireland equalled €154.2 billion. That’s what Irish depositors would be owed if all banks, credit unions, and building societies under Ireland’s DGS failed. But where would that money come from?

Some of it would come from the institutions covered by the Irish DGS. The idea being that the DGS is paid for by the banks, not the taxpayer. Banks must make annual contributions to a deposit guarantee fund so that they’re paying for the cost of a future bank failure, today. This pool of money is referred to as Qualified Available Financial Means (QAFM).

Every DGS in the EU must have QAFM equal to 0.8% of Covered Deposits. A lower QAFM of 0.5% can be permitted in certain circumstances. Ireland’s DGS had QAFM equal to €1.2 billion at the end of 2024 and its minimum requirements have been met. QAFM alone can’t cover a doomsday scenario (in Ireland, €1.2bn QAFM vs. €154.2bn covered deposits).

QAFM is maintained at 0.8% because multiple large banks are unlikely to fail simultaneously. The EU doesn’t want to take too much money out of the economy to prepare for an event that rarely happens. QAFM is designed to cover most smaller failures.

If a large failure(s) were to happen that couldn’t be covered by QAFM or additional contributions from the banks, every EU country is required to have Alternative Funding Means in place to make sure their DGS can honour the repayments to depositors within 7 working days.

Alternative Funding Means could include:

- State-Funded Loans: a loan provided by the Government to the DGS.

- Commercial Loans: a loan provided by a bank or other lender.

- Inter-DGS Loans: a loan provided by one DGS to another.

Crucially, any loans made to the DGS must be repaid by the remaining banks through their annual contributions or ‘levies’. The only way that the taxpayer would be left with the bill is if a State-Funded Loan was used to bailout the DGS and the remaining banks were unable to afford the levies to repay it.

Key Takeaway:

If your deposits are covered by the DGS, then the safety of a bank is not a major concern. That’s because your money is guaranteed by the State up to €100,000.

This is why DGSs are effective in preventing ‘bank runs’ - where lots of depositors attempt to withdraw their money at the same time, potentially causing a bank to collapse. If depositors know that their deposits are guaranteed then they have no reason to run.

The question of whether a bank is safe is more relevant to Uncovered Deposits and deposits in excess of €100,000. That said, the overall health of the banking sector remains crucial to the health of the economy, and it's in everyone’s best interests that banks continue to be in good standing.

How are Money Market Funds (MMFs) Protected?

Money Market Funds (MMFs) are investment products, not bank accounts. This means they are not protected by the Deposit Guarantee Scheme (DGS). However, there are other significant protections in place that practically eliminate the risk of losing money with MMFs, making them a great option for savers.

MMFs are regulated by the European Union under Regulation (EU) 2017/1131. This is commonly known as the EU Money Market Fund Regulation (MMFR). Because of MMFR:

- Investors are protected: MMFR keeps your money stable and instantly accessible when invested in MMFs, similar to a bank account.

- The economy is more stable: Governments, companies and banks use MMFs for funding. MMFR makes them more resilient, reducing the risk of an economic shock.

- The rules are consistent: All MMF investment managers in the EU must comply with MMFR. The rules are the same for everyone because MMFR is an EU Regulation, not a Directive.

Did You Know?

Ireland is the leading location of choice for MMFs in Europe. Over 40% of all European MMFs are set up or ‘domiciled’ in Ireland. MMFs that are set up in Ireland are under the supervision of the Central Bank of Ireland.

To learn more about Money Market Funds (MMFs), you can check out our dedicated MMF page.

MMFs are protected by an EU Directive called the Investor Compensation Scheme (ICS). If the broker fails to safeguard your MMF shares, you will be entitled to compensation. The minimum compensation is 90% of your loss or €20,000, whichever is lower.

To learn more about the Investor Compensation Scheme (ICS), you can check out our investment protections page.

Your MMF shares must be kept separate from the broker’s assets under law. This is called ‘Asset Segregation’. The benefit of this is that if your broker fails, your MMF shares cannot be touched by the companies that the broker owes money to (their ‘creditors’). Your MMF shares would then be returned to you.

How Banks Are Regulated in Europe

European banks are regulated to prevent failures that could damage the economy and cause harm to consumers. To reduce the risk of a crisis, regulators apply strict rules on banks, dictating what they can and can’t do.

The responsibility of regulating a bank usually lies with a country’s central bank. In Ireland, that’s the Central Bank of Ireland.

Four main types of regulation are used to protect consumers and the financial system:

In order to start a bank, you need a license. This requires a rigorous authorisation process to ensure the people starting the bank are qualified and the business model is compliant.

Getting authorisation is no joke and it can take banks years to get, if they ever do. Once a bank does get authorised, it’s continuously monitored to make sure it stays compliant with the rules.

Authorisation plays a key role in the regulation process, especially in the EU. Once an EU country authorises a bank to operate, that bank can conduct business in other EU countries. This is called ‘passporting’.

Every European regulator must ensure their authorisation standards are high for the benefit of all other regulators.

If many people withdraw money from a bank at the same time, can that bank cover all the withdrawals? Prudential regulation is there to make sure that it does. It’s the responsibility of the regulator who authorised the bank to enforce these rules.

Every regulator will set rules about how a bank can and can’t interact with its customers. Everything from how a bank does business with you to the information that they advertise is governed by these rules. These are local rules, so the bank has to comply with the rules that are in place in each country that it operates in.

- Irish Context: In Ireland, these rules stem from the Consumer Protection Code and are regulated by the Central Bank of Ireland.

This is why European banks operating in Ireland have disclosures like “authorised by the Austrian Financial Markets Authority in Austria and is regulated by the Central Bank of Ireland for conduct of business rules”. The bank got its license in Austria but complies with Irish rules for its business with Irish customers.

Regulators will set rules for banks so that the entire financial system can withstand a shock. This is commonly known as systemic or ‘macroprudential’ regulation.

- Regulators introduce macroprudential regulation wherever they think vulnerability exists. For example, after the global financial crisis, the Central Bank of Ireland introduced macroprudential regulations on mortgages, limiting how much people could borrow.

Key Takeaway:

When you’re dealing with a regulated bank, there are many rules in place to protect you. Some protections, like the DGS, are clear. Others, like the four types of regulation, are often overlooked.

DGS Frequently Asked Questions

Yes, the Irish DGS has been used in the past, but mainly for credit unions. Between 2014 and 2020, compensation was paid out under the Irish DGS for the failure of Berehaven Credit Union, Rush Credit Union, Charleville Credit Union and Drumcondra and District Credit Union.

The accounts eligible for the DGS are current accounts, savings accounts and credit union share accounts.

Yes, but your personal and business accounts with the same bank will be combined for the €100,000 limit. If you incorporate your business, your personal account and company account will be treated separately.

Every European bank is required to provide you with a Depositor Information Sheet. This will tell you which Deposit Guarantee Scheme the bank falls under.

The DGS of the foreign bank’s home country will apply. If you have deposits with an Irish branch of an Austrian bank, your deposits are covered by the Austrian DGS, not the Irish DGS. However, the Irish DGS will assist the Austrian DGS in making payments where necessary.

The equivalent deposit protection scheme of the non-EU bank’s home country will apply, if any. However, the Irish DGS may provide you with cover if it decides that the protection provided by the non-EU scheme isn’t on par with the EU DGS.

It’s possible that your bank holds its license in a country that has a DGS denominated in a different currency. For example, in Sweden, the DGS limit is SEK 1,150,000 (from 1 January 2026). If the SEK weakens against the Euro, your actual cover may be less than €100,000 until the currency strengthens or the Swedish regulator increases the protection.

No, UK deposits are covered by the Financial Services Compensation Scheme (FSCS) which is different to the DGS. The FSCS has a protection limit of £120,000 per depositor, per bank (from 1 December 2025). Temporary high balances are protected up to £1,400,000 for 6 months.

How much protection you receive under the FSCS will depend on the exchange rates between GBP and Euro.

However, if the investing platform itself fails and you lose money because they didn’t deposit with a regulated bank, you’ll only be eligible for the Investor Compensation Scheme (ICS). This is also the case where Money Market Funds (MMFs) are used to store cash, the investing platform fails and your assets aren't safeguarded, leading to loss.

No, the credit rating of the country doesn’t matter. If the country needed to raise money to provide a State-Funded Loan to its DGS, a poor credit rating may slow this process down. But each EU country is required to honour its DGS’ requirements. If there was ever an issue, other EU countries or the European Central Bank (ECB) would likely step in to assist.

No, a lower QAFM is nothing to be concerned about. A DGS’ QAFM can go down if there has been a recent payout. Additional levies will be paid by the remaining banks to bring it back up to the target of 0.8% of Covered Deposits. There are also Alternative Funding Means available if a payout needs to be made and there isn’t enough QAFM.

If you’re in arrears on your loan(s), the liquidator of the bank has the right to offset the arrears balance against your entitlement under the DGS. For example, if you had €50,000 in deposits but were in arrears for €5,000, your DGS payout would be €45,000.

Mortgages and other outstanding loans not in arrears are not offset against your entitlement under the DGS.

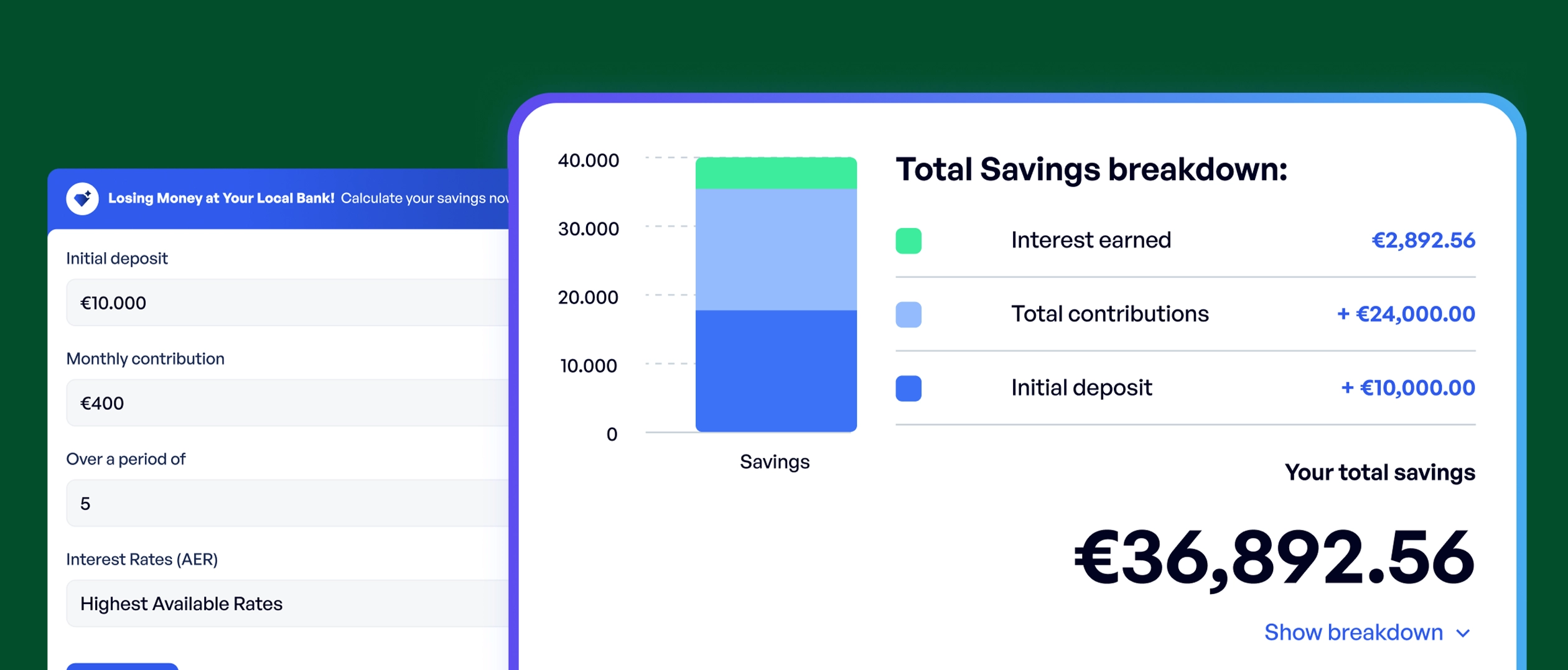

Savings Calculator

Calculate how much you can save over time, and get matched with the best accounts.

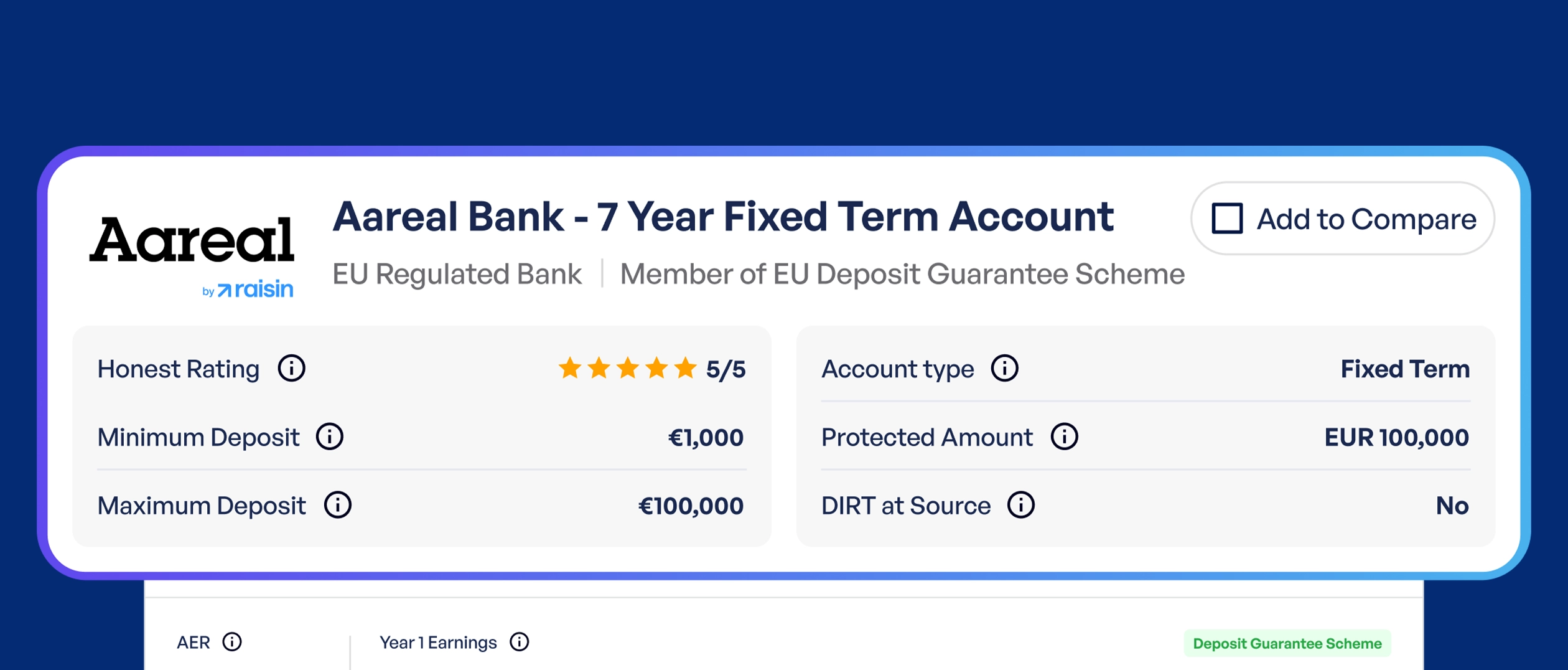

Savings Comparison Tool

Compare over 200 savings accounts side-by-side for detailed analysis.